Let’s be honest: a lot of factors can work against you when it comes to securing a cheap car insurance policy.

Your location, your driving record, and even your age can pose risks to insurance providers, meaning you’re going to see rate hikes. But affordable rates aren’t impossible to find if you know where to look.

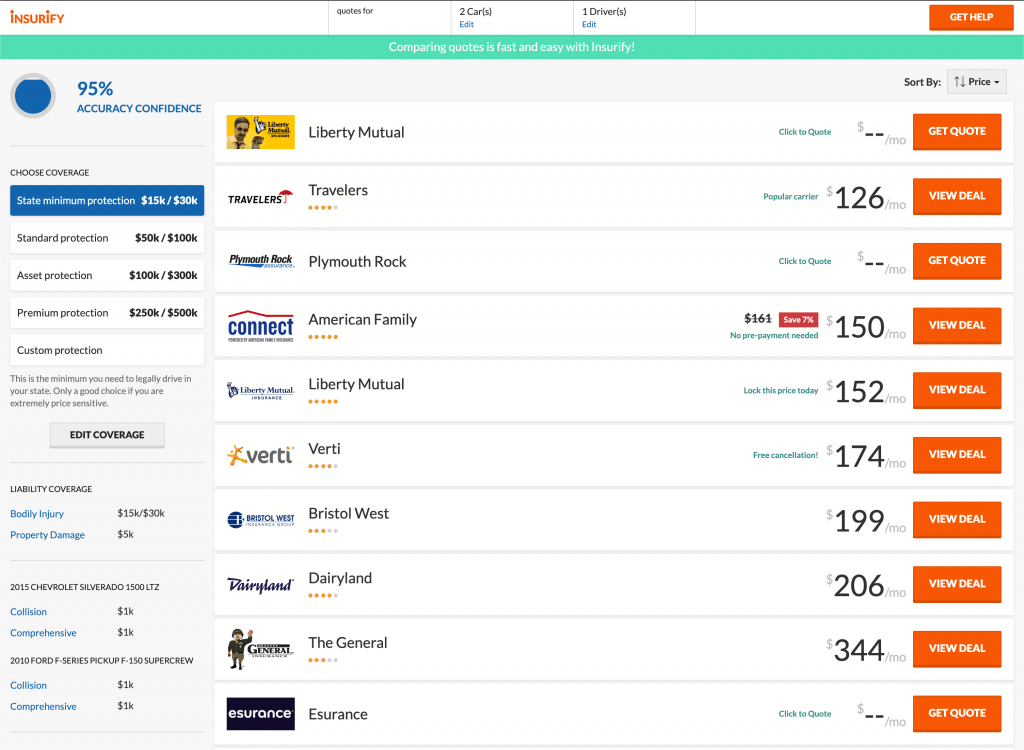

Insurify has compiled the stats on the best and most affordable car insurance rates in the nation, broken down by location, company, driving factors, and even demographic variables.

Your wallet is about to get a whole lot happier after finding the best deal with Insurify’s car insurance comparison.

Score savings on car insurance with Insurify

Table of Contents

- Cheapest car insurance quotes by state

- Average car insurance quotes by state

- Cheap car insurance quotes: liability versus full coverage

- Cheap car insurance quotes for teens

- Cheap SR-22 car insurance

- Cheap car insurance by credit score

- Cheapest car insurance quotes for higher-risk drivers

- Speeding

- Accidents

- DUI

- Cheapest car insurance quotes by identity

- Age

- Marital status

- How to get the cheapest car insurance near you

- Methodology

Cheapest Car Insurance Quotes by State

According to Insurify’s official research, here are the cheapest car insurance providers for each U.S. state, including the average monthly premium amount offered by those providers.

| State | Cheapest Insurance Provider | Average Monthly Premium |

| Alabama | National General | $115 |

| Alaska | American Family | $153 |

| Arizona | Hallmark | $114 |

| Arkansas | Liberty Mutual | $176 |

| California | Metromile | $167 |

| Colorado | Sun Coast General | $202 |

| Connecticut | Homesite | $181 |

| Delaware | Travelers | $255 |

| Florida | Dairyland | $276 |

| Georgia | Everest National | $201 |

| Hawaii | Farmers | $109 |

| Idaho | Liberty Mutual | $103 |

| Illinois | USH&C | $132 |

| Indiana | Dairyland | $103 |

| Iowa | Liberty Mutual | $113 |

| Kansas | Liberty Mutual | $164 |

| Kentucky | Bristol West | $210 |

| Louisiana | Clearcover | $290 |

| Maine | Liberty Mutual | $103 |

| Maryland | MetLife | $186 |

| Massachusetts | Travelers | $123 |

| Michigan | Arrowhead | $461 |

| Minnesota | American Family | $148 |

| Mississippi | Dairyland | $184 |

| Missouri | Safeco | $210 |

| Montana | Hallmark | $122 |

| Nebraska | MetLife | $157 |

| Nevada | Liberty Mutual | $233 |

| New Hampshire | Liberty Mutual | $121 |

| New Jersey | Travelers | $203 |

| New Mexico | Hallmark | $113 |

| New York | Travelers | $230 |

| North Carolina | Homesite | $101 |

| North Dakota | American Family | $155 |

| Ohio | Liberty Mutual | $128 |

| Oklahoma | Hallmark | $138 |

| Oregon | Bristol West | $152 |

| Pennsylvania | Good2Go Auto | $132 |

| Rhode Island | Hallmark | $299 |

| South Carolina | Liberty Mutual | $234 |

| South Dakota | American Family | $141 |

| Tennessee | Hallmark | $133 |

| Texas | Alinsco | $177 |

| Utah | Bristol West | $150 |

| Vermont | Travelers | $122 |

| Virginia | National General | $137 |

| Washington | National General | $175 |

| Washington, D.C. | Travelers | $214 |

| West Virginia | Liberty Mutual | $155 |

| Wisconsin | MetLife | $117 |

| Wyoming | MetLife | $120 |

Average Car Insurance Quotes by State

The average American driver isn’t always going to be able to secure the cheapest car insurance rate. After all, not all drivers have a sterling record or are willing to pay only for state minimum liability insurance.

As of 2020, Hawaii is the state with the lowest average car insurance rates, with $107 being the typical monthly car insurance premium.

Michigan is the real standout here—Michigan drivers can expect an average car insurance quote around $479 a month.

But that doesn’t mean affordable auto insurance coverage can’t be found wherever you live. Remember, Insurify can secure you a cheap quote, no matter your background, driver profile, or insurance needs. You can even find cheap car insurance with no deposit necessary—just look for the words “No Down Payment” on your Insurify quote list!

| State | Average Monthly Premium |

| Alabama | $168 |

| Alaska | $144 |

| Arizona | $179 |

| Arkansas | $176 |

| California | $195 |

| Colorado | $210 |

| Connecticut | $224 |

| Delaware | $290 |

| District of Columbia | $270 |

| Florida | $291 |

| Georgia | $286 |

| Hawaii | $107 |

| Idaho | $121 |

| Illinois | $157 |

| Indiana | $137 |

| Iowa | $134 |

| Kansas | $165 |

| Kentucky | $245 |

| Louisiana | $293 |

| Maine | $117 |

| Maryland | $270 |

| Massachusetts | $171 |

| Michigan | $479 |

| Minnesota | $147 |

| Mississippi | $189 |

| Missouri | $228 |

| Montana | $144 |

| Nebraska | $177 |

| Nevada | $275 |

| New Hampshire | $142 |

| New Jersey | $259 |

| New Mexico | $147 |

| New York | $308 |

| North Carolina | $119 |

| North Dakota | $143 |

| Ohio | $148 |

| Oklahoma | $170 |

| Oregon | $179 |

| Pennsylvania | $175 |

| Rhode Island | $315 |

| South Carolina | $268 |

| South Dakota | $130 |

| Tennessee | $163 |

| Texas | $231 |

| Utah | $159 |

| Vermont | $130 |

| Virginia | $182 |

| Washington | $217 |

| West Virginia | $181 |

| Wisconsin | $138 |

| Wyoming | $115 |

Cheap Car Insurance Quotes: Liability versus Full Coverage

Each insurance policy has different coverage limits. Simply put, how much coverage you select will impact your overall car insurance costs. A basic, bare-bones state minimum plan will typically cost less than a comprehensive “umbrella” policy with added insurance products like personal injury protection. However, cheap quotes are still out there, even if you’re opting for “full coverage.”

State Minimum Coverage Only

| Insurance Provider | Average Monthly Premium |

|---|---|

| Hallmark | $98 |

| MetLife | $107 |

| Dairyland | $119 |

| Aggressive Insurance | $129 |

| Sun Coast General | $130 |

| Alinsco | $131 |

| AssuranceAmerica | $133 |

| Bristol West | $133 |

| Motion Auto | $141 |

| GAINSCO | $143 |

| Clearcover | $146 |

| Homesite | $148 |

| Commonwealth Casualty | $156 |

| Aspen | $159 |

| Jupiter | $159 |

| Homesite | $148 |

| Infinity | $194 |

| Mercury | $164 |

| Liberty Mutual | $166 |

| Direct Auto | $168 |

| Travelers | $169 |

| Kemper | $171 |

| Quantum | $172 |

| Texas Ranger | $191 |

| Mile Auto | $193 |

| American Family | $193 |

| Infinity | $194 |

| Elephant.com | $199 |

| The General | $231 |

| Freedom National | $239 |

| Arrowhead | $289 |

Full Coverage

The following quotes correspond to this coverage level: $50,000 bodily injury liability per person; $100,000 overall bodily injury liability; $50,000 property damage liability; comprehensive and collision coverage at a $1,000 deductible each. A car insurance provider would designate this policy type as “full coverage.”

| Insurance Provider | Average Monthly Premium |

|---|---|

| Hallmark | $230 |

| Sun Coast General | $252 |

| Verti | $274 |

| Clearcover | $278 |

| Alinsco | $279 |

| 21st Century Insurance | $290 |

| Mile Auto | $296 |

| Commonwealth Casualty | $298 |

| Aggressive Insurance | $299 |

| Liberty Mutual | $304 |

| Travelers | $304 |

| Kemper | $309 |

| AssuranceAmerica | $311 |

| Mercury | $312 |

| Arrowhead | $315 |

| GAINSCO | $316 |

| American Family | $318 |

| Dairyland | $328 |

| MetLife | $333 |

| Workmen’s | $334 |

| Infinity | $357 |

| Elephant.com | $362 |

| Freedom National | $364 |

| Bristol West | $378 |

| Direct Auto | $416 |

| Apparent Insurance | $450 |

Cheap Car Insurance Quotes for Teens

Teens are typically seen as higher-risk drivers. That’s why even the cheapest car insurance rates for teens, even for liability-only policies, will be higher than those an adult driver will encounter.

| State | Cheapest Monthly Premium | Insurance Provider |

|---|---|---|

| Alaska | n/a | n/a |

| Alabama | $316 | Bristol West |

| Arkansas | $318 | Jupiter Auto |

| Arizona | $309 | Bristol West |

| California | $334 | Anchor |

| Colorado | $349 | Sun Coast General |

| Connecticut | $504 | American Family |

| Washington DC | $613 | Liberty Mutual |

| Delaware | $580 | Liberty Mutual |

| Florida | $520 | Bristol West |

| Georgia | $533 | Gainsco |

| Hawaii | $107 | Farmers Insurance |

| Iowa | $113 | Liberty Mutual |

| Idaho | $257 | The General |

| Illinois | $244 | Mercury |

| Indiana | $199 | Hallmark |

| Kansas | $327 | American Family Insurance |

| Kentucky | $390 | Bristol West |

| Louisiana | $604 | The General |

| Massachusetts | $378 | The General |

| Maryland | $488 | American Family |

| Maine | $264 | The General |

| Michigan | $741 | Arrowhead |

| Minnesota | $283 | American Family |

| Missouri | $443 | Kemper |

| Mississippi | $333 | Bristol West |

| Montana | $273 | The General |

| North Carolina | $190 | American Family |

| North Dakota | $318 | The General |

| Nebraska | $308 | American Family |

| New Hampshire | $317 | The General |

| New Jersey | $423 | Travelers |

| New Mexico | $307 | GAINSCO |

| Nevada | $542 | Dairyland Insurance |

| New York | $590 | Plymouth Rock |

| Ohio | $273 | Elephant.com |

| Oklahoma | $287 | Mercury |

| Oregon | $376 | Mile Auto |

| Pennsylvania | $287 | Bristol West |

| Rhode Island | $719 | Liberty Mutual |

| South Carolina | $498 | Bristol West |

| South Dakota | $286 | Dairyland Insurance |

| Tennessee | $236 | Bristol West |

| Texas | $283 | Alinsco |

| Utah | $319 | Freedom National |

| Virginia | $326 | GAINSCO |

| Vermont | n/a | n/a |

| Washington | $398 | Bristol West |

| Wisconsin | $253 | First Chicago Insurance |

| West Virginia | $399 | Liberty Mutual |

| Wyoming | $223.93 | Dairyland Insurance |

Cheap SR-22 Car Insurance

An SR-22 certification, a.k.a. Certificate of Financial Responsibility, is proof that you carry enough car insurance coverage to meet your state’s minimum requirements. Drivers are required to get an SR-22 bond after having had their driver’s license suspended or revoked.

Drivers often struggle to find car insurance quotes when they need to file for an SR-22—not all Insurance providers will file on a policyholder’s behalf. Still, because most drivers who require an SR-22 are not opting into high coverage car insurance, they’re able to secure relatively cheap policies.

| No SR-22 | SR-22 | |||

|---|---|---|---|---|

| State | Cheapest Monthly Premium | Insurance Provider | Cheapest Monthly Premium | Insurance Provider |

| Alaska | $160 | American Family | ---- | ---- |

| Alabama | $125 | National General | $165 | Arrowhead |

| Arkansas | $153 | Liberty Mutual | $200 | Dairyland |

| Arizona | $112 | Hallmark Insurance | $175 | Bristol West |

| California | $167 | Farmers Insurance | $158 | 21st Century |

| Colorado | $212 | Sun Coast General | $177 | Sun Coast General |

| Connecticut | $183 | Homesite | -- | -- |

| Washington DC | $218 | Travelers | -- | -- |

| Delaware | $272 | Travelers | -- | -- |

| Florida | $283 | Dairyland | $278 | Travelers |

| Georgia | $206 | Everest National | $236 | Direct Auto |

| Hawaii | $116 | Farmers Insurance | $127 | Farmers Insurance |

| Iowa | $122 | Liberty Mutual | 152 | Dairyland |

| Idaho | $110 | Liberty Mutual | $127 | Dairyland |

| Illinois | $131 | USH&C | $151 | Dairyland |

| Indiana | $106 | Dairyland | $110 | Dairyland |

| Kansas | $168 | Liberty Mutual | $169 | Dairyland |

| Kentucky | $215 | Bristol West | $216 | Bristol West |

| Louisiana | $253 | The General | $293 | Clearcover |

| Massachusetts | $130 | Travelers | -- | -- |

| Maryland | $200 | MetLife | $286 | Travelers |

| Maine | $146 | Homesite | -- | -- |

| Michigan | $475 | Arrowhead | $426 | Arrowhead |

| Minnesota | $156 | American Family | -- | -- |

| Missouri | $215 | Safeco | $202 | Assurance America |

| Mississippi | $189 | Dairyland Insurance | -- | -- |

| Montana | $135 | Hallmark | $150 | The General |

| North Carolina | $105 | Homesite | $115 | National General |

| North Dakota | $149 | Safeco | $155 | The General |

| Nebraska | $163 | MetLife | $197 | The General |

| New Hampshire | $129 | Liberty Mutual | $159 | The General |

| New Jersey | $221 | Travelers | $327 | Mercury |

| New Mexico | $119 | Hallmark Insurance | -- | -- |

| Nevada | $263 | Liberty Mutual | $276 | Kemper |

| New York | $234 | Travelers | $556 | Liberty Mutual |

| Ohio | $139 | MetLife | $159 | Dairyland |

| Oklahoma | $140 | Hallmark | $151 | Bristol West |

| Oregon | $158 | Bristol West | $170 | Mile Auto |

| Pennsylvania | $134 | Good2Go | $163 | Dairyland |

| Rhode Island | $297 | Homesite | -- | -- |

| South Carolina | $247 | Liberty Mutual | $266 | AssuranceAmerica |

| South Dakota | $143 | Safeco | $145 | Dairyland |

| Tennessee | $129 | Hallmark | $150 | Dairyland |

| Texas | $163 | Aggressive | $182 | Hallmark |

| Utah | $154 | Bristol West | $183 | Dairyland |

| Virginia | $141 | National General | $143.19 | National General |

| Vermont | $113 | Homesite | -- | -- |

| Washington | $183 | National General | $164 | National General |

| Wisconsin | $121 | MetLife | $118 | Dairyland |

| West Virginia | $166 | Liberty Mutual | $181 | Dairyland |

| Wyoming | $129 | Safeco | $126 | Dairyland |

Cheap Car Insurance by Credit Score

Unfortunately, in many states, it’s fair game to discriminate against drivers based on credit score.

| State | Cheapest Premium | Provider |

|---|---|---|

| Alaska | $141 | American Family |

| Alabama | $178 | AssuranceAmerica |

| Arkansas | $188 | American Family |

| Arizona | $198 | Commonwealth Casualty |

| California | $116 | Aspire General |

| Colorado | $177 | Sun Coast General |

| Connecticut | $187 | American Family |

| Washington DC | $156 | Travelers |

| Delaware | $208 | American Family |

| Florida | $239 | Dairyland |

| Georgia | $279 | Gainsco |

| Hawaii | $110 | Farmers Insurance |

| Iowa | $151 | Dairyland |

| Idaho | $140 | Dairyland |

| Illinois | $124 | First Chicago |

| Indiana | $138 | First Chicago |

| Kansas | $144 | American Family Insurance |

| Kentucky | $232 | SafeAuto |

| Louisiana | $281 | The General |

| Massachusetts | $121 | Travelers |

| Maryland | $208 | Travelers |

| Maine | $121 | The General |

| Michigan | $339 | Liberty Mutual |

| Minnesota | $123 | American Family |

| Missouri | $232 | Assurance America |

| Mississippi | $198 | Dairyland Insurance |

| Montana | $169 | The General |

| North Carolina | $109 | American Family |

| North Dakota | $156 | The General |

| Nebraska | $205 | The General |

| New Hampshire | $141 | The General |

| New Jersey | $184 | Travelers |

| New Mexico | $150 | Dairyland Insurance |

| Nevada | $272 | Dairyland Insurance |

| New York | $188 | Liberty Mutual |

| Ohio | $149 | SafeAuto |

| Oklahoma | $201 | GAINSCO |

| Oregon | $137 | MetroMile |

| Pennsylvania | $151 | MetroMile |

| Rhode Island | $244 | American Family |

| South Carolina | $260 | GAINSCO |

| South Dakota | $109 | American Family |

| Tennessee | $166 | Dairyland |

| Texas | $230 | Dairyland |

| Utah | $173 | GAINSCO |

| Virginia | $154 | MetroMile |

| Vermont | 126 | Dairyland |

| Washington | $188 | Metromile |

| Wisconsin | $121 | First Chicago Insurance |

| West Virginia | $224 | The General |

| Wyoming | $146 | Dairyland Insurance |

Cheapest Quotes for Drivers with Excellent Credit Scores

The following auto insurance companies offer the best deals for drivers with excellent or sterling credit. Just look at how low the quotes can go:

| Insurance Provider | Average Monthly Premium |

| Farmers | $112 |

| Aspire General | $116 |

| First Chicago | $125 |

| USH&C | $154 |

| MetLife | $167 |

Cheap High-Risk Car Insurance

How do your driving habits impact your car insurance rates?

Better driving will typically lead to cheaper car insurance rates. This is the rule of thumb through which insurance companies assess drivers’ risk profiles. Your driving history is the most accurate indication of whether or not you’re likely to file a claim…and insurance providers don’t want to shell out big bucks if they can help it.

How can you manage to find a cheap auto insurance policy even if your driving record isn’t spotless? It’s possible—bad drivers need car insurance, too!

Cheapest Car Insurance for Drivers with a Speeding Ticket

It’s true; insurance providers are more likely to cover drivers with clean driving records. While we’d all like to have a spotless reputation on the road, our expectations don’t always match reality.

So you got pulled over for going 55 in a 35. Okay, it happens. Virtually all insurance companies will cover drivers who have a few speeding violations in the near past. Remember, a speeding ticket from over seven years ago will be virtually scrubbed from your insurance record, and your rates will gradually go down as you continue careful and safe driving in the years to come.

Still, here are the cheapest car insurance quotes you could secure with a speeding ticket to your name:

| State | Cheapest Monthly Premium | Insurance Provider |

|---|---|---|

| Alaska | n/a | n/a |

| Alabama | $146 | National General |

| Arkansas | $187 | Direct Auto |

| Arizona | $138 | Clearcover |

| California | $136 | Metromile |

| Colorado | $173 | Bristol West |

| Connecticut | $291 | Plymouth Rock |

| Washington DC | $273 | American Family |

| Delaware | $273 | American Family |

| Florida | $235 | Bristol West |

| Georgia | $175 | Freedom National |

| Hawaii | $124 | Farmers Insurance |

| Iowa | $110 | American Family |

| Idaho | $155 | Dairyland |

| Illinois | $110 | Mile Auto |

| Indiana | $118 | Travelers |

| Kansas | $154 | American Family Insurance |

| Kentucky | $211 | Travelers |

| Louisiana | $321 | The General |

| Massachusetts | $87 | Travelers |

| Maryland | $215 | Travelers |

| Maine | $165 | The General |

| Michigan | $531 | Arrowhead |

| Minnesota | $145 | American Family |

| Missouri | $160 | Travelers |

| Mississippi | $182 | Direct Auto |

| Montana | $182 | The General |

| North Carolina | $99 | National General |

| North Dakota | $236 | The General |

| Nebraska | $163 | American Family |

| New Hampshire | $218 | The General |

| New Jersey | $191 | Plymouth Rock |

| New Mexico | $144 | GAINSCO |

| Nevada | $231 | Travelers |

| New York | $229 | Plymouth Rock |

| Ohio | $106 | Clearcover |

| Oklahoma | $176 | Travelers |

| Oregon | $123 | Mile Auto |

| Pennsylvania | $130 | Travelers |

| Rhode Island | n/a | n/a |

| South Carolina | $189 | Travelers |

| South Dakota | $171 | Dairyland |

| Tennessee | $163 | Elephant.com |

| Texas | $125 | Clearcover |

| Utah | $118 | Sun Coast General |

| Virginia | $153 | Elephant.com |

| Vermont | n/a | n/a |

| Washington | $177 | Safeco Insurance |

| Wisconsin | $116 | Clearcover |

| West Virginia | $201 | American Family |

| Wyoming | $160 | Dairyland Insurance |

Cheapest Car Insurance for Drivers with an At-Fault Accident

Drivers with an at-fault accident from the past seven years on their record will likely see a spike in their insurance premiums. However, the severity of that price increase will diminish over time until the incident is virtually expunged from your insurance record. Even if you’ve made a claim for an accident that wasn’t your fault, certain insurance companies might weigh your risk a little bit heavier next time they’re calculating your auto insurance rates.

| State | Cheapest Monthly Premium | Insurance Provider |

|---|---|---|

| Alaska | n/a | n/a |

| Alabama | $125 | Travelers |

| Arkansas | $188 | Safeco |

| Arizona | $145 | Travelers |

| California | $121 | Travelers |

| Colorado | $176 | MetLife |

| Connecticut | $183 | Plymouth Rock |

| Washington DC | $372 | American Family |

| Delaware | $252 | American Family |

| Florida | $257 | Bristol West |

| Georgia | $191 | Freedom National |

| Hawaii | $123 | Farmers Insurance |

| Iowa | $130 | American Family |

| Idaho | $172 | Dairyland |

| Illinois | $101 | Metromile |

| Indiana | $99 | Travelers |

| Kansas | $171 | American Family Insurance |

| Kentucky | $181 | Travelers |

| Louisiana | $367 | The General |

| Massachusetts | $68 | Travelers |

| Maryland | $174 | MetLife |

| Maine | $147 | The General |

| Michigan | $581 | Arrowhead |

| Minnesota | $151 | American Family |

| Missouri | $150 | Travelers |

| Mississippi | $187 | Direct Auto |

| Montana | $180 | The General |

| North Carolina | $100 | National General |

| North Dakota | $184 | The General |

| Nebraska | $177 | American Family |

| New Hampshire | $228 | The General |

| New Jersey | $171 | Plymouth Rock |

| New Mexico | $170 | GAINSCO |

| Nevada | $240 | Travelers |

| New York | $196 | Travelers |

| Ohio | $118 | Travelers |

| Oklahoma | $150 | Travelers |

| Oregon | $124 | Mile Auto |

| Pennsylvania | $107 | MetroMile |

| Rhode Island | $463 | American Family |

| South Carolina | $164 | Travelers |

| South Dakota | $161 | Dairyland |

| Tennessee | $153 | Travelers |

| Texas | $182 | Clearcover |

| Utah | $134 | Sun Coast General |

| Virginia | $145 | MetLife |

| Vermont | 126 | Dairyland |

| Washington | $167 | Travelers |

| Wisconsin | $104 | Travelers |

| West Virginia | $230 | American Family |

| Wyoming | $151 | Dairyland Insurance |

Cheapest Car Insurance for Drivers with a DUI

As you can imagine, car insurance companies won’t always look kindly on drivers with a DUI in their record.

But just because your DUI has led to a license suspension doesn’t mean these companies won’t file an SR-22 on your behalf or cover you after you no longer need to provide proof of insurance.

| State | Cheapest Premium | Provider |

|---|---|---|

| Alaska | n/a | n/a |

| Alabama | $136 | Dairyland |

| Arkansas | $153 | Direct Auto |

| Arizona | $117 | Sun Coast General |

| California | $174 | Anchor |

| Colorado | $129 | Sun Coast General |

| Connecticut | $190 | Plymouth Rock |

| Washington, D.C. | n/a | n/a |

| Delaware | n/a | n/a |

| Florida | $182 | Direct Auto |

| Georgia | $148 | Freedom National |

| Hawaii | n/a | n/a |

| Iowa | $133 | Dairyland |

| Idaho | $108 | Dairyland |

| Illinois | $137 | Bristol West |

| Indiana | $109 | USH&C |

| Kansas | $171 | The General |

| Kentucky | $189 | Bristol West |

| Louisiana | $221 | The General |

| Massachusetts | n/a | n/a |

| Maryland | $259 | Elephant.com |

| Maine | $136 | The General |

| Michigan | $406 | Arrowhead |

| Minnesota | $139 | Travelers |

| Missouri | $147 | AssuranceAmerica |

| Mississippi | $160 | Dairyland |

| Montana | $159 | The General |

| North Carolina | $104 | National General |

| North Dakota | $173 | The General |

| Nebraska | $191 | Dairyland |

| New Hampshire | n/a | n/a |

| New Jersey | $189 | Plymouth Rock |

| New Mexico | $126 | GAINSCO |

| Nevada | $208 | Kemper |

| New York | $213 | Plymouth Rock |

| Ohio | $107 | Travelers |

| Oklahoma | $140 | GAINSCO |

| Oregon | $91 | Kemper |

| Pennsylvania | $130 | American Family |

| Rhode Island | n/a | n/a |

| South Carolina | $221 | AssuranceAmerica |

| South Dakota | n/a | n/a |

| Tennessee | $116 | GAINSCO |

| Texas | $161 | Bristol West |

| Utah | $108 | Kemper |

| Virginia | $123 | National General |

| Vermont | n/a | n/a |

| Washington | $132 | National General |

| Wisconsin | $127 | Dairyland |

| West Virginia | $185 | Dairyland |

| Wyoming | n/a | n/a |

If your license has been suspended or revoked as a result of a DUI conviction, insurance companies may be able to file an SR-22 or FR-44 on your behalf, demonstrating your proof of insurance.

Cheap Car Insurance for Young vs. Old Drivers and Married vs. Single Drivers

It’s sad but true: there are, indeed, factors beyond your control that will affect how much you shell out in car insurance costs.

The insurance industry applies complex algorithms to set each drivers’ rates. That means that the demographic features of your driver profile, from your gender to your age to your marital status, can have a slight or profound effect on your car insurance price tag. Hey, at least they don’t discriminate by hair color.

Cheap Car Insurance for Young vs. Old Drivers

While “older driver” doesn’t always mean “safe driver,” teen drivers and young adults are statistically more likely to engage in risky driving behaviors. As a result, insurance companies will likely weigh a more inexperienced driver’s age against them when determining their risk profile.

Here are the cheapest car insurance quotes available to drivers over the age of 40 versus over the age of 40:

| Over 40 | Under 40 | |||

|---|---|---|---|---|

| State | Cheapest Monthly Premium | Insurance Provider | Cheapest Monthly Premium | Insurance Provider |

| Alaska | $128 | American Family | $183 | American Family |

| Alabama | $95 | National General | $123 | National General |

| Arkansas | $126 | Hallmark | $185 | Jupiter Auto |

| Arizona | $111 | Hallmark Insurance | $201 | Mercury |

| California | $113 | Freedom National | $221 | Freedom National |

| Colorado | $175 | Bristol West | $230 | Sun Coast General |

| Connecticut | $200 | Liberty Mutual | $305 | Liberty Mutual |

| Washington DC | $173 | Liberty Mutual | $215 | Travelers |

| Delaware | $224 | Travelers | $324 | American Family |

| Florida | $233 | Dairyland | $321 | Gainsco |

| Georgia | $203 | GAINSCO | $298 | GAINSCO |

| Hawaii | $110 | American Family | $118 | Farmers Insurance |

| Iowa | $104 | Liberty Mutual | $143 | Liberty Mutual |

| Idaho | $88 | Liberty Mutual | $135 | Liberty Mutual |

| Illinois | $73 | USH&C | $97 | USH&C |

| Indiana | $73 | Dairyland | $110 | Dairyland |

| Kansas | $129 | Dairyland | $194 | Travelers |

| Kentucky | $174 | Bristol West | $231 | Bristol West |

| Louisiana | $234 | The General | $349 | The General |

| Massachusetts | $93 | Travelers | $118 | Travelers |

| Maryland | $220 | Safeco | $276 | Travelers |

| Maine | $92 | Liberty Mutual | $129 | Travelers |

| Michigan | $389 | Liberty Mutual | $461 | Arrowhead |

| Minnesota | $130 | Liberty Mutual | $162 | Travelers |

| Missouri | $178 | Liberty Mutual | $258 | Safeco |

| Mississippi | $148 | Dairyland Insurance | $227 | Direct Auto |

| Montana | $122 | The General | $174 | Travelers |

| North Carolina | $108 | Dairyland | $137 | Dairyland |

| North Dakota | -- | -- | $173 | The General |

| Nebraska | $138 | Liberty Mutual | $189 | Travelers |

| New Hampshire | $107 | Liberty Mutual | $169 | Liberty Mutual |

| New Jersey | $186 | Travelers | $247 | Travelers |

| New Mexico | $107 | Hallmark Insurance | $136 | Hallmark Insurance |

| Nevada | $228 | Kemper | $313 | Travelers |

| New York | $211 | Travelers | $255 | TSC Direct |

| Ohio | $118 | Liberty Mutual | $150 | Liberty Mutual |

| Oklahoma | $114 | Hallmark | $161 | Hallmark |

| Oregon | $143 | Bristol West | $195 | Liberty Mutual |

| Pennsylvania | $142 | Bristol West | $163 | Dairyland |

| Rhode Island | $277 | American Family | $375 | American Family |

| South Carolina | $214 | AssuranceAmerica | $282 | Liberty Mutual |

| South Dakota | $112 | Dairyland | $174 | American Family |

| Tennessee | $96 | Hallmark | $146 | GAINSCO |

| Texas | $133 | Commonwealth Casualty | $208 | Aggressive Insurance |

| Utah | $121 | Freedom National | $183 | Sun Coast General |

| Virginia | $111 | National General | $140 | National General |

| Vermont | -- | -- | -- | -- |

| Washington | $181 | National General | $201 | National General |

| Wisconsin | $101 | First Chicago | $139 | Liberty Mutual |

| West Virginia | $147 | Safeco | $203 | Liberty Mutual |

| Wyoming | $104 | Dairyland | $138 | Dairyland |

How to get the cheapest car insurance quotes near you

Car insurance can be a nightmare. Whether you’re overpaying on your current policy or downright confused by the complex terminology, we’re here to help.

You’ve seen that it’s possible to secure cheap car insurance quotes, even without the most stellar driving record. Now, here are some parting tips on how to make sure you’re getting the hands-down cheapest rate possible:

- Consider whether you really need “full coverage” for your auto policy. While liability coverage is mandatory almost everywhere in the United States and comes as the standard coverage of any auto insurance plan, additional coverage options come with their own price tags. Collision coverage and comprehensive coverage, though the standards of a so-called full coverage car insurance policy, require deductibles and will raise your rates beyond what you’d get for a state minimum policy. Similarly, uninsured motorist coverage is a recommended coverage option for the typical American driver, but not if you’re a low-mileage driver looking to secure the cheapest quotes possible.

- Secure all the car insurance discounts for which you’re eligible. Good driver discounts, good student discounts, multi-policy discounts, multi-vehicle discounts, defensive driving course discounts… Dozens of identity factors, affiliations, driving behaviors, and positive choices can qualify you for lower car insurance rates. (And if you are a former or active military member, you should explore buying insurance through USAA.) The more committed you are to staying safe on the road, keeping up an admirable driving record, and giving back to your community, the more likely it is that an insurance company will reward you with substantial rate decreases. Make sure you’ve exhaustively reviewed a company’s discounts before you buy a car insurance policy. Don’t leave money on the table!

- Purchase anti-theft devices for your car. Shelling out a few bucks for a more advanced car alarm system or more secure auto parts may lead to long-term savings. Companies don’t want to insure vehicles that are not adequately secured, much less those that appear to invite a carjacking. Owning or leasing a car that has up-to-date, built-in safety features might score you some discounts as well.

- Keep a good credit score, if you can. Though a handful of states are outlawing this practice, the fact remains that insurance companies can factor your credit health into your auto insurance rates. Whether or not your credit history is a significant signal of your risk level is up for debate. But for now, poor credit can mean higher rates.

- Don’t forget about customer service, claims satisfaction, and other intangibles. The best car insurance companies in America receive high marks from policyholders, not merely because they secure them the cheapest rates. In fact, many of them are not industry-leading in terms of affordability (see above)! They’re the best because they are financially healthy, have excellent customer reviews, and will service your claims in a timely fashion. Sure, Company A might demand a $5 higher rate per month when compared to Company B. But which provider has a better industry and public reputation? Which one has a mobile app that works for you? Which one won’t raise your rates for merely staying loyal, or for getting in your first at-fault accident? If the price is still relatively right, consider going with the company that will turn your car insurance nightmares into sweet dreams.

Finally, there’s one way that you can find the best rates around, lower your insurance costs, and spare yourself a lot of angry phone calls: Insurify. Insurify acts like an online insurance agent, connecting drivers and homeowners with insurers that can offer them lower premiums and the cheapest online quote.

Insurify offers free car insurance quotes to drivers of all stripes. Compare low-cost home insurance, life insurance, and auto insurance quotes from top-ranked national and regional companies, unlock discounts for which you’re eligible, and buy a policy today. There’s more than just GEICO, Progressive, and State Farm out there—despite what your TV might tell you. No games, no hassle, and real quotes from real providers like Liberty Mutual, Nationwide, Travelers, and more.

Cheap Car Insurance FAQ

How do I get cheap car insurance online?

Comparing car insurance quotes is the best way for you to get an idea of how low you can go. Getting quotes from one company at a time is time-consuming and limiting. Remember, every carrier quotes differently, so if you're looking for the cheapest rate for you, consider shopping on a car insurance quotes comparison platform like Insurify.

Where can I get cheap car insurance?

Insurance agents, brokers, and phone operators are standing by to offer you car insurance. But this is the 21st century, and many drivers are choosing to take things digital, and take their insurance decisions into their own hands. Skip the trips and scam calls and collect cheap car insurance quotes online with Insurify. Choose between state minimum, full coverage, and premium coverage levels, and see how much you can save. The average shopper saves $489 a year on Insurify!

How does Insurify work?

Insurify lets you compare cheap car insurance quotes online, no matter your driving record, location, or age. Take 2 minutes to enter your information, and Insurify will generate up to 10+ real, ready-to-buy car insurance quotes from top national and regional insurance companies. You can even unlock discounts and adjust coverage levels as needed. Buy online or over the phone. The best part? It's 100% free. No spam, no gimmicks.

Methodology

The data scientists at Insurify compiled quoting data from Insurify’s proprietary database of over 2 million real car insurance quotes, pricing data spanning from 2013 to 2020.

All quotes correspond to state minimum car insurance coverage (bodily injury liability and property damage liability insurance coverage) in their respective states, unless where noted.