Image may be NSFW.

Clik here to view.

You need car insurance to drive. You don’t need it to drive you crazy.

Mistake #1: You’re lining agents’ pockets instead of your own.

Perhaps you’ve entrusted your friendly neighborhood agent to find a car insurance policy that’s best for you.

Not so fast! You might be leaving money on the table.

Auto insurance agents will go out of their way to sell you more expensive policies, even if there are cheaper options out there. That’s because they get higher commissions from certain companies over others.

How are you SURE you’re getting the best price from an agent?

Mistake #2: You haven’t given yourself an insurance checkup for more than a year.

When’s the last time you took a hard look at your car insurance policy? Do you know your coverages and deductibles inside and out? Would you know who’s covered, and for how much in damages, in the case of an accident?

(We’ll wait.)

Insurance companies update their rates every year. So if it’s been over a year, you may be paying more than you first bargained for—even if nothing has changed in your personal or driver profile.

Some companies also may increase your rate without even telling you. How else would they pay for those flashy Super Bowl ads to lure in new customers?

Plus, there’s the simple fact that the coverage you currently have may not be the coverage you need right now. Sure, that rental reimbursement coverage sounded great at the time. But you’ve really seen no need for it. And what about that mechanical breakdown coverage your agent nudged you into buying? That doesn’t make much sense for your certified pre-owned Honda.

You might even be eligible for more discounts than you know. Dozens of discounts abound for safe drivers, good drivers, married drivers, and even drivers who receive their bills via email.

Mistake #3: You’re too loyal.

We get it. The folks at your insurance company are like family to you.

They’re there for you when you need them (sometimes). They’re just lovely to speak to on the phone. They’ll make you tear your hair out and, quite possibly, cry.

See what we did there?

You can’t choose your family, but you can choose your insurance company. And just because you’ve been with the same insurance provider year after year doesn’t mean you’re getting adequately rewarded for customer loyalty.

In fact, if you haven’t switched your insurance company in over a year, you’re likely overpaying for the same coverage. Insurance providers update their rates each year, which means they may boost your premiums without warning.

A provider with a better policy for you may be out there. You might get the same or better coverage for less than what you’re paying now.

Right the wrongs. Here’s how to fix your mistakes with Insurify.

It’s never too late to own up to your mistakes. But how can you move forward from them, too? And maybe secure a sweet deal in the meantime?

We started Insurify because we also made these mistakes while shopping for car insurance. That’s why we decided to create one site that can get you the best deal on your car insurance in three easy steps.

Image may be NSFW.

Clik here to view.

Solution #1: Insurify scores you the savings, and we cheer you on from the sidelines.

With Insurify, you’re in the driver’s seat. You trust yourself to compare grocery prices and apartment leases. Why aren’t you comparing your car insurance, too?

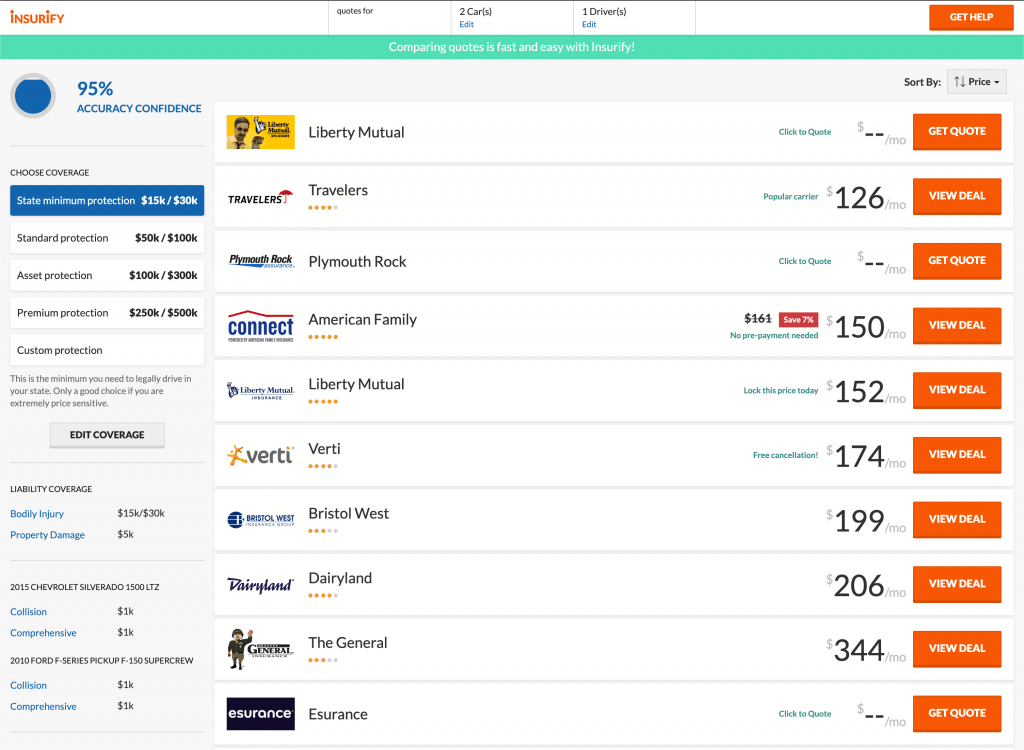

Insurify is the one-stop-shop to compare car insurance quotes, secure discounts, and choose between coverage levels without any external pressure or purchase necessary.

Solution #2: We let you build your ideal policy based on what YOU want and need.

Use Insurify to set your own deductibles, unlock discounts based on your profile, find companies that won’t charge you cancellation fees, and even commit to a six-month policy so that you’re not locked down forever.

Simply put, we’ll give you the tools you need to build your dream car insurance policy.

>> BUILD YOUR OWN INSURANCE POLICY <<

Solution #3: Insurify makes it easy for you to switch and save.

We know you’re always in the mood for real savings. That’s why Insurify provides real, not estimated, quotes from actual insurance companies.

Say hello to your new insurance plan: whether you choose based on price, down payment amount, customer service reviews, or some other feature is up to you. And it doesn’t hurt that you might save an average of $489 a year on your policy.

Love your insurance, love your wallet, love yourself.