Looking for cheaper insurance rates, but don’t know where to start? This site claims it can uncover savings on your car insurance.

The Zebra is an insurance search engine and car insurance comparison site based in Austin. The Zebra allows users to compare and shop insurance quotes from top national and regional insurance companies. Like other auto insurance quote comparison sites, it’s on a mission to disrupt the insurance industry and empower users to do their own insurance shopping online.

It’s also taken an irreverent approach in tackling the industry:

In this article

How does The Zebra work?

The Zebra offers insurance quotes from over 200 car insurance companies, including Farmers, Liberty Mutual, and The General.

Just enter your personal information, including elements of your driving record, and you’ll soon be presented with a variety of car insurance quotes that fit your coverage needs and risk profile.

When this author tested out The Zebra’s flow, the final page showed five quotes, with one quote from Travelers listed at $92 per month and four links to other websites that I could use to see more quotes. Each link allowed the user to see the coverage levels offered in each plan. The Zebra also provides a phone number to contact a team of insurance agents, who offer customer support and service over the phone.

Each quote included a company rating, policy features, and a button that would either take you to the company’s website or allow you to compare it with another company. A list of options on the left side of the page allowed a user to check off certain features to include in the insurance policy and the site would eliminate companies not offering those features.

Users can alter the parameters of what they want out of their auto insurance (say, changing coverage levels, adding or removing roadside assistance coverage, or changing their comprehensive and collision deductible amounts). The car insurance rates provided by The Zebra will adjust accordingly. However, the company did not allow this author to customize coverage preferences, forcing a choice between one of five pre-assembled car insurance packages. Additionally, while users are able to see which common car insurance discounts they prequalify for earlier in the comparison process, there was not ultimately an option to see which discounts were tied to which insurance company.

The Zebra Reviews: Here’s what customers are saying…

Customer reviews from around the web indicate that The Zebra’s technology is usually able to present a variety of auto insurance quotes. The site has a 4.8/5 overall satisfaction rating from Shopper Approved, based on 2,049 ratings as of this writing.

The Zebra prides itself on being not a lead generation site, but an auto and home insurance comparison platform that can also connect you to licensed agents.

Have users been able to secure lower insurance premiums? Reviewers on Shopper Approved are mostly satisfied:

…but every now and then, customer service qualms persist:

This table shows The Zebra’s official Insurify Composite Rating, based on a combination of reviews from aggregator sites:

| Site | Customer Rating | Number of Reviews |

|---|---|---|

| Total Score | 4.57 / 5 | 2,978 |

| Shopper Approved | 4.8 / 5 | 2,049 |

| Clearsurance | 3.88 / 5 | 420 |

| HighYa | 4.4 / 5 | 290 |

| Better Business Bureau (BBB) | 4.4 / 5 | 109 |

| SiteJabber | 3.6 / 5 | 110 |

The Zebra

is rated

4.57 out of 5 based on

2978 reviews.

The Zebra’s Better Business Bureau (BBB) profile is also a helpful resource to get an idea of its customer satisfaction track record:

| Better Business Bureau Rating | A |

|---|---|

| BBB Total Customer Reviews | 109 |

| BBB Customer Complaints | 7 |

The Zebra vs. Insurify

What are the main differences between Insurify and The Zebra? Both insurance comparison websites are safe and free to use, allow consumers to compare personalized car and homeowners insurance quotes in real-time, and don’t sell customer’s personal data or send spam phone calls or texts. Both companies also feature favorable customer reviews; Insurify currently boasts a 4.3/5 Google customer satisfaction rating based on 262 reviews, while The Zebra has a slightly lower 4.2 rating, out of 147 reviews.

Insurify customers can save up to $996 annually, while The Zebra advertises that customers can save up to $670. Insurify is also officially accredited with an A+ rating from the Better Business Bureau, while The Zebra is not. And unlike The Zebra, Insurify also allows users to compare term life insurance quotes.

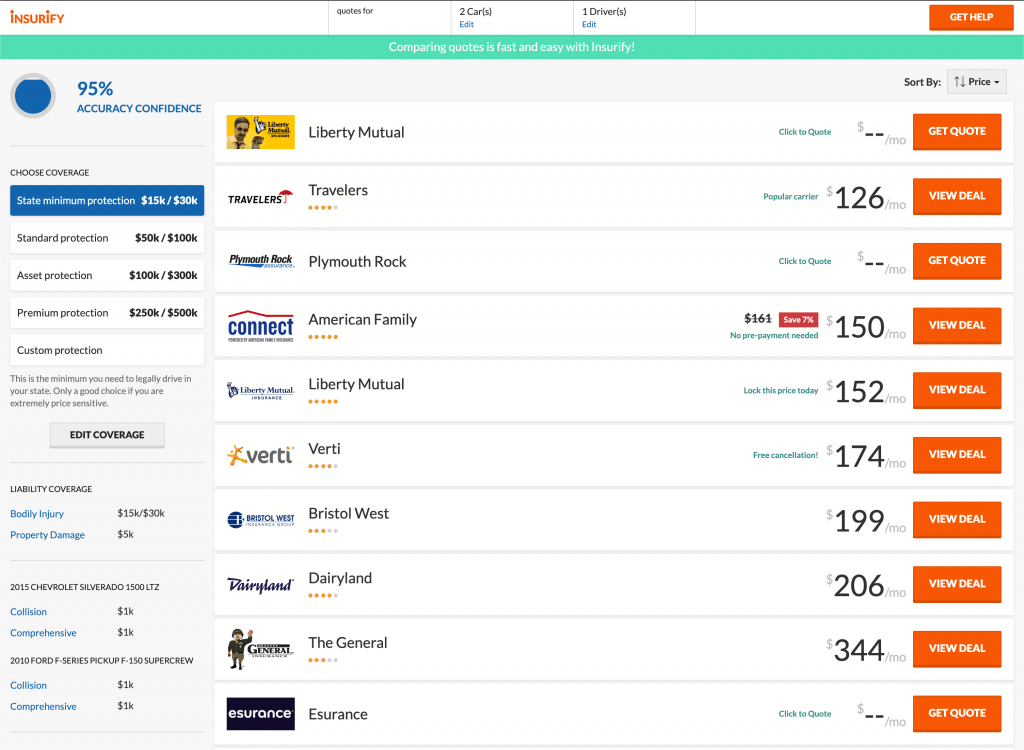

With Insurify, you can compare quotes for auto, life, and home insurance, all on one simple platform. After taking just two minutes to enter your information, you’ll get a quotes page featuring an average of five to seven quotes side-by-side from top insurance providers.

Operating like a 24/7 virtual insurance agency, Insurify provides accurate quotes in real-time from some of the nation’s biggest insurers, like Allstate and Liberty Mutual.

To date, Insurify has saved up to $996 annually for customers living from coast to coast, from Berkeley to Birmingham to Boston! With an average customer satisfaction rating of 4.75/5 from 3000+ reviews, Insurify is the #1 highest-ranked insurance comparison platform in America.

With Insurify you can unlock discounts and rock-bottom pricing on your auto insurance rates, discovering an insurance policy and premium that works for you and for your budget.

The Zebra vs. Gabi

Gabi is another insurance comparison website, one which you can read more about at our 10 Best & Worst Sites to Compare Car Insurance Quotes page. What are the similarities and differences between The Zebra and Gabi?

Both sites are well-regarded, have at least four out of five stars in customer reviews on Google, and allow users to quickly and easily compare car insurance quotes. Gabi, however, specializes in using customer’s current insurance policies to help find them new quotes, giving customers the ability to link their current insurance account to Gabi’s site or upload a PDF of their policy.

Because Gabi works best when it can examine a customer’s current policy, it might not be the best option for you if you’ve never had car insurance before. On the flip side, if you’re someone who doesn’t like to spend a lot of time inputting personal information, Gabi might be a good idea, since you can upload your current policy as a PDF or link your insurance account and let Gabi do the work for you.

By contrast, The Zebra emphasizes its ability to use AI to quickly deliver real quotes in real-time based on information inputted by the user. If you’re looking for the quickest possible online comparison experience or are new to the world of car insurance, The Zebra might be the way to go.

Currently, unlike Insurify, neither The Zebra nor Gabi offer a way to compare life insurance products.

More about The Zebra

A startup founded in 2012 by co-founders Joshua Dziabiak and Adam Lyons, Insurance Zebra Insurance Services was initially launched in Texas and California in 2013 and now serves drivers nationwide at thezebra.com as an auto insurance comparison site.

The Zebra has been featured in publications such as Forbes, TechCrunch, and Inc.

Contact Information

| Headquarters | 98 San Jacinto Blvd #2000 Austin, TX 78701 |

| Phone number | 1 (888) 255-4364 |

| Website | www.thezebra.com |

The Zebra FAQs

What does The Zebra do?

Founded in 2012, The Zebra is an auto and home insurance quotes comparison site that allows users to shop quotes from top national and regional insurance companies. It provides estimated car and home insurance quotes to drivers across the country.

What are the pros and cons of using The Zebra?

The Zebra has above-average reviews from verified users on ShopperApproved. As such, it is one of the more favorably rated auto insurance quotes comparison sites out there. However, it may not appeal to insurance shoppers who want a wide variety of real-time quotes to choose from without speaking to an agent. It also may not appeal to those who are interested in applying discounts to their car insurance policies or customizing their policy beyond a preassembled package.

How is Insurify different from The Zebra?

Both Insurify and The Zebra are safe and free to use, allow consumers to compare personalized car and home insurance quotes in real-time, and don't sell customer's personal data or send spam calls or texts. However, Insurify customers can save up to $996 annually, while The Zebra advertises that customers can save up to $670. Insurify is also officially accredited with an A+ rating from the Better Business Bureau, while The Zebra is not. And unlike The Zebra, Insurify also allows users to compare term life insurance quotes.