Image may be NSFW.

Clik here to view.

Up to 70 percent in instant savings are at your fingertips when you compare car insurance quotes every six months. Let Insurify unlock discounted rates to fit your driver profile.

Different car insurance companies often produce very different quotes for the same person, even if the policies being compared are identical. This makes comparison shopping a crucial part of buying an auto insurance policy. Wise shoppers will compare at least four or five different insurance providers to make sure they are getting a good deal.

Auto insurance comparison websites, which let you instantly compare auto insurance quotes from multiple insurance providers like GEICO, State Farm, and USAA, can be a massive help in your quest for affordable or cheap car insurance. They provide personalized rates, discounts, and coverage options all on one site—much like your favorite travel comparison site providing you with side-by-side airline ticket or hotel room options all on a single page.

In order to provide an accurate list of options, comparison sites ask you for necessary information such as your ZIP code, occupation, vehicle make and model, marital status, and driving history. These details allow the site to provide an accurate list of different insurance policies, options, and rates.

However, not all sites that claim to provide insurance quotes are the real thing.

In this article

How Auto Insurance Quote Comparison Sites Work

There are two main types of insurance comparison websites: quote comparison sites and lead generation sites. Auto quote comparison websites present users with rates based on information submitted during the shopping experience. You can then decide which quote to pursue, and the data you enter is transferred to the agent or company website, significantly shortening the purchasing process. These sites do not sell your information to auto insurance companies or agencies.

Unlike quote comparison sites, lead generation sites often sell your information to their advertising partners—typically insurance companies. These sites are not built to provide you with personalized quotes and are not much help when trying to compare car insurance rates. Avoid these sites unless you’re eager to receive tons of cold calls from insurance phone banks and desperate agents.

Insurance comparison websites can be broken down further into sites that provide real-time insurance quotes and those that provide estimated ones. Estimated quotes are derived from historic data and are often out of date. To get the most accurate information, you should use a site that provides real-time quotes generated by the insurance companies.

Clik here to view.

The 10 Best & Worst Sites to Compare Car Insurance Quotes

Insurify and The Zebra provide users with real home and car insurance quotes in real-time, automatically generated based on inputted information. Gabi and Policygenius more often provide quotes via email or text after a waiting period. And other sites like Nerdwallet and Compare.com redirect users to an insurer's website. The quotes such lead-generation sites ultimately provide are usually less personalized, and customers may see smaller savings.

Score savings on car insurance with Insurify

When shopping for car insurance quotes, are you looking for real, accurate, full coverage quotes with competitive pricing? Or are you looking for a quick estimate that an agent might change later on in your shopping journey?

Will the site you’re on know the exact liability limits in your state, so you don’t end up underinsured? Will it make sure you’re matched to a quote that isn’t a year old or more and makes sense in your ZIP code? Don’t get swindled by an ad-riddled bot site or lead-gen charlatans. Whether you’re driving in sunny California or snowy New York, windy Wyoming or tropical Hawaii, make sure you’re getting the best deal on your coverage.

Read on to learn more, or just take a quick peek at the chart below to see how the ten best and worst sites to compare car insurance look side-to-side.

| Site | Customer Reviews (ShopperApproved) | Customer Reviews (TrustPilot) | Number of Quotes | Real Prices in Real-Time Onsite? |

|---|---|---|---|---|

| Insurify | 4.8 | N/A | 12 | Yes |

| The Zebra | 4.8 | 3.5 | 5 | Yes |

| Jerry | N/A | N/A | 5 | Yes |

| Gabi | N/A | N/A | 3 | Yes |

| PolicyGenius | N/A | 4.7 | 2 | No |

| Compare.com | N/A | 2.5 | 3 | Yes |

| Nerdwallet | 4.4 | 1.5 | 3 | No |

| QuoteWizard | N/A | 3.1 | 2 | No |

| SmartFinancial | N/A | N/A | 5 | No |

| ValuePenguin | N/A | 3.2 | 1 | No |

Best Car Insurance Comparison Sites with Real Quotes

The following comparison sites offer real-time, accurate insurance quotes.

Insurify

Image may be NSFW.

Clik here to view.

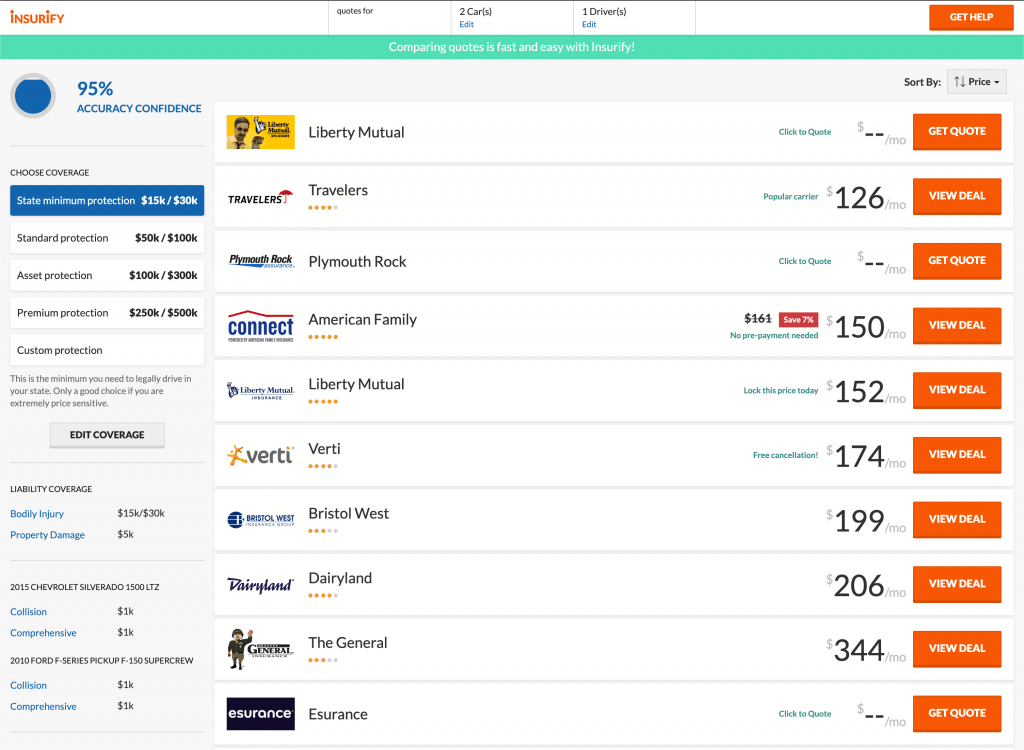

Insurify is a free insurance comparison website that provides real-time, accurate quotes from top insurance companies in the U.S. to drivers nationwide. On average, Insurify customers save $585 per year on car insurance. With an average customer satisfaction rating of 4.75/5 from 3000+ reviews, Insurify is the #1 highest-ranked insurance comparison platform in America.

The site offers a wide variety of insurance companies to choose from, an easy-to-use interface, and can effectively service drivers in all segments of the market. To date, it has delivered millions of car insurance quotes from top providers such as The General, MetLife, and Liberty Mutual. And whether you live in Massachusetts and Michigan, Insurify’s got you covered––the site provides quotes for motorists in all fifty states.

Insurify has been featured on Forbes, the Wall Street Journal, CNET, and TechCrunch and is considered one of the top auto insurance comparison sites.

How it works: Insurify asks shoppers to answer a series of questions that it uses to produce real-time, accurate quotes. In addition to its mobile and desktop sites, the site also offers the ability to receive quotes and buy an insurance policy via Facebook Messenger.

The questions were easy to answer, and the process was straightforward—I was able to submit my information and get personalized and free car insurance quotes in under five minutes.

Results: Insurify produced nine quotes, starting at $78/month, each with the option to contact the insurance company immediately or schedule a phone call for a later time. Some of the quotes included helpful information about the policy or the insurance company offering it. The site allowed me to change the coverage from the left-hand sidebar, and it was easy to click on the different coverages and see the prices change in real-time.

Clicking on the button to the right of each quote brought up a pop-up window with more details about the policy, payment information, and options to buy a policy via phone or Internet.

The site also included ads for certain insurance companies, and clicking the “Check Rate” button for the ad connected me directly to the insurance provider’s website. It’s easy to tell the ads from the quotes; the ads all say “ad” next to the company name, and the button says “Check Rate” rather than “View Deal.”

Insurify’s quote comparison tool was a great help in shopping for car insurance. I particularly liked how easy it was to compare rates based on a custom coverage level. With a few clicks, I could alter the parameters (say, by changing the liability coverage limits or adding roadside assistance) and get a whole new batch of quotes instantly.

Score savings on car insurance with Insurify

Every year, Insurify also publishes a Best Car Insurance Companies list, ranking the top insurers in America based on overall quality score.

RELATED CONTENT FROM INSURIFY

- How to find cheap insurance prices with no deposit or down payment required

- Get full coverage car insurance with no credit check necessary

- Read our ultimate guide to SR-22 insurance for high-risk drivers.

- Learn more about car insurance for Uber, Lyft, and other rideshare drivers.

Jerry

GetJerry, also known as Jerry.ai, is designed to work like a personal insurance shopper. It takes less than a minute to sign up, and Jerry does all the insurance research for you. It compares personalized car, home, renters, and umbrella insurance quotes from up to 45 different insurance companies and provides you with your three best options when it comes time to renew. And Jerry doesn’t share your phone number with insurance agents, so you won’t get any sales phone calls.

How it works: The signup process for Jerry is painless and takes less than a minute. You’ll answer a few questions about whether you have car insurance, whether you’ve filed any claims in the last five years, and whether you’ve been issued any tickets in the last five years.

You’ll then need to enter your full name and phone number and verify your phone number by entering the four-digit code Jerry sends you. Jerry will then locate your current policy. It takes just a few minutes to complete the onboarding, and then Jerry will analyze your current coverage and let you know via text if it finds a cheaper deal than your current one. It’ll bring up about five quotes for you to choose from at this time, from top companies like GEICO and Progressive. You may need to edit the coverage amounts and deductibles to meet your needs before making a selection.

Results: From this point on, Jerry puts your insurance shopping on autopilot by automatically acquiring up to 45 insurance quotes and giving you three options to choose from before every renewal. And when you want to switch, Jerry handles all the paperwork for you. You won’t have to speak to an agent or any salespeople to set up your new policy.

Once you’re signed up at GetJerry.com, you can download the mobile app, which offers you digital access to your home and car insurance cards. This is also where all communication occurs with Jerry. I appreciated Jerry’s mobile app, but sometimes found its customer interface to be confusing and ultimately received fewer car insurance quotes than I did through Insurify.

The Zebra

The Zebra is another free auto insurance comparison website. The site’s name refers to its founders’ goal of presenting “insurance in black and white.” TheZebra.com has a few articles about choosing car insurance, a car insurance calculator, and some necessary information about other types of insurance in addition to its quoting tool. The Zebra is rated 4.2 out of 5 on Google and has 1,989 user reviews on ShopperApproved.

How it works: The quoting process was similar to that of other comparison websites and featured an attractive web design, as well as the ability to remember previous sessions and select certain discounts. After I entered the requested information, the site spent less than a minute processing my quotes.

Results: The final page offered five quotes, with one quote from Travelers listed at $92 per month and four links to other websites that I could use to get more quotes. I could open each link to see the coverage levels offered in each plan. The site also offered the option to speak with an agent. Each quote included a company rating, policy features, and a button that would either take you to the company’s website or allow you to compare it with another company. A list of options on the left side of the page allowed me to check off the features that I wanted to include, and eliminated companies not offering those features.

The Zebra didn’t allow me to customize coverage preferences, forcing me to choose one of five pre-assembled packages. It also didn’t list which companies provided which discounts, making their earlier list of pre-qualified discounts that I selected less useful. I was also frustrated by the fact that I only received one quote live on The Zebra’s website, while the other options redirected me to different company websites. However, I appreciated The Zebra’s ease of use and attractive design.

Car Insurance Comparison Sites with Non-Real-Time Quotes

Unlike Insurify and The Zebra, some comparison sites primarily provide asynchronous quotes, rather than automatically-generated real-time ones. That means that customers usually don’t get to see their car insurance quotes instantly, and have to wait instead.

These sites ask customers to upload a copy of their current insurance plan or enter information about their driving history. The site will then email or text the customer with a list of new quotes that are less expensive than their current plan after a waiting period that could be as long as 48 hours. That means that quotes for specific coverage options for specific drivers––a policy for a Texas driver seeking property damage protection after an incident of vandalism, say, or a driver seeking accident forgiveness and bodily injury coverage after being in a past at-fault accident––may take longer, and may not be as accurate.

The following sites fall into this category:

Gabi

Gabi is an insurance services company and licensed insurance agency that claims to save customers up to hundreds on their insurance premiums by comparing insurance quotes against your current policy. Gabi advertises itself as a “full-service, online advisor who compares all your insurance options to find you the right policy, all in under two minutes.” Users can link their current insurance to their Gabi.com account or send Gabi a PDF of their current insurance policy. Gabi has a 4.8 / 5 rating on Google.

How it works: Like other comparison site flows, Gabi asks for some necessary information, like your name, address, and previous insurance company. Early on, however, I had to create an account linked to my email address and mobile phone number, adding some extra steps to the comparison process. Since Gabi specializes in comparing insurance rates against your current plan, it isn’t ideal for the first-time insurance shopper. However, if you aren’t currently insured, you have the option to indicate “I Don’t Have Insurance” early on in the flow, and you should still be able to find quotes. This is the option that I selected.

Results: Even without linking a current insurance company’s account, I was still able to receive three quotes…after I’d built out my driver profile with vehicle information and specifics about my driving record. If I selected a quote, I had to enter the remaining details about my driving record (such as my driver’s license number) before moving on to payment preferences. Furthermore, Gabi followed up with texts to my cell number, which was technically convenient, but which I found to be something of an annoyance.

Though I was able to customize my car insurance coverage options and get a few quotes, I got the sense that Gabi’s biggest strength is its ability to compare quotes against one’s current policy, a feature Policygenius also offers. Otherwise, Gabi’s flow was similar to other estimated quote comparison sites, with the extra steps of account setup that seemed unnecessary.

Policygenius

Policygenius is another competitor in the insurance comparison market. The site itself specializes in providing guidance with regards to life, disability, homeowners, pet, renters, and auto insurance—the quoting tool, created through a partnership with CoverHound, is a newer product.

How it works: Clicking “Get Quotes” on Policygenius’ auto home page led me to a flow that touted the ability to compare home and auto quotes at the same time. I opted to search for auto quotes only. The site explained that I would input personal information about myself and receive a quote mailed to me within a couple days. Put off by the long wait time, I decided to compare home and auto insurance together instead. I was then asked a series of questions about my home and car, including my car’s age, make, model, and vehicle identification number.

Results: After about five minutes of home and auto-related questions, I was finally asked to provide my email address and phone number to receive quotes. I was also asked to upload my insurance policy, with the promise of receiving quotes in 1-2 days. While the user experience was clean and straightforward, I would have preferred fewer questions and real-time quotes without having to upload my homeowners and auto policy declarations pages at any point in the process. I was also disappointed by the lack of automatic quotes and the wait time.

If bundling policies is what you’re after, give Policygenius a try. For folks itching to get auto-only quotes, this might not be the site for you.

Lead Generation Sites

Unlike quote comparison sites, many lead generation sites are paid when they send customers’ personal information to external agencies.

These sites often attract your interest with competitive rates that promise to help you save money, but then transfer you to a different site to continue shopping and complete your transaction, usually for a far less attractive price. This is because lead generation sites are often paid to sell your information to an agency or insurance company, not to present you with rates on car insurance.

Image may be NSFW.

Clik here to view.

You can sometimes get auto insurance quotes on lead generation sites, but expect them to be far less reliable than quotes from comparison sites. Using lead generation sites most likely means that you’ll end up wandering from one auto insurance website to another in pursuit of the best rate, which defeats the purpose of using a quote-generating site at all.

Compare.com

Compare.com is an auto insurance comparison website that helps customers find insurance coverage from auto insurance companies. Founded in 2013, the site claims to make finding the best deal on car insurance a breeze, and the company partners with several well-known insurers like Geico, MetLife, and USAA.

How it works: When it comes to car insurance, Compare.com gathers expected personal information about you, your driving history, marital status, and your vehicle. You will also be asked about your current insurance provider and coverage. I began my shopping experience on Compare.com’s homepage, which prompts you to enter your zipcode and begin filling out an intake form. While there are more questions on the intake form than many other comparison sites, the form is easy to navigate, and offered the option to add a second vehicle to my plan for a 20% discount. Because I indicated that I rent an apartment, the site also asked if I would like to bundle a renters and auto insurance policy together.

Results: After filling out the form, the site took just a few seconds to process the data that I inputted. Afterward, a list of 3 different quotes from 3 insurance companies appeared. Two––GEICO and Liberty Mutual––were traditional insurance companies, while the third, The Zebra, was yet another insurance comparison site.

When I clicked on The Zebra option, I was redirected to yet another insurance comparison experience. When I clicked on the Liberty Mutual option, I was prompted to input several more screens of more information before seeing my rate. The same occurred with GEICO, leading me to wonder why I inputted my personal information into Compare.com in the first place.

While the quotes I received were reasonable and competitive with my current insurer, receiving just two actual quotes seemed quite limited to me––particularly when I can access up to twenty auto insurance quotes and compare them side by side at Insurify.

There were also limited customization options on the Compare.com website. I wasn’t able to select between different types of insurance policy categories, choose a deductible, or compare pricing between car insurance options on the website. I couldn’t even see my actual quote. To see any of those things, I had to funnel through the three sites that Compare.com recommended for me.

Nerdwallet

Nerdwallet.com is a popular personal finance website that offers free comparison tools for car, health, and life insurance quotes. The site also has reviews of different insurance providers and numerous tips for picking the best policy. Nerdwallet is rated 4.4 out of 5 from 2,840 user reviews on ShopperApproved. Nerdwallet’s car insurance comparison product is enabled by a partnership with insure.com.

How it works: Nerdwallet’s quoting process was extremely simple. Starting at the site’s insurance homepage, I selected the car insurance option. I was prompted to enter my zipcode and answer a few questions. When I selected the “not currently insured” option, I was referred to three insurance providers (Progressive, Geico, and Esurance) in a pop-up, but not provided with any quotes. I was also offered the option to continue the comparison experience with Nerdwallet, where I was asked a few more questions about myself and my vehicle.

Results: At the end of my comparison process, Nerdwallet referred me to the same three providers that had popped up earlier: Progressive, Geico, and Esurance. There were no live quotes available on Nerdwallet’s site. When I clicked on the Esurance and Progressive options, I was directed to restart my application process at those sites. When I clicked on the Geico option, the link was broken, so I wasn’t even redirected to the site.

While Nerdwallet provides many helpful and informative articles on personal finance, its car insurance comparison product features some bugs, like the broken link, and the fact that I didn’t receive any real quotes even after inputting my personal information left me feeling frustrated.

QuoteWizard

QuoteWizard.com bills itself as a source for articles and information about insurance, as well as an insurance comparison site. The site promises to help users compare car, home, health and life insurance policies, though the site actually froze and crashed the first time that I attempted to use the home insurance product.

How it works: The site’s car insurance quoting process was smooth but basic, asking some quick questions about my vehicle, city of residence, and marital status. When I clicked on the site’s Terms of Use, I learned that the quoting product was actually owned and run by LendingTree, and that my personal information, including my Social Security Number and credit history, could be shared with LendingTree affiliates, NetWork partners, financial companies, “other business partners”, and, perhaps most frighteningly, at the site’s “sole discretion” in a number of different situations.

Results: After disclosing my personal information, I was taken to a page with no quotes but with links to two insurers: Progressive and Geico. When I clicked on the link, I was redirected to the beginning of that insurer’s quoting process. I was also immediately called by an insurance agent and received texts from two different phone numbers––one likely spoofed to resemble my zipcode––which I hadn’t requested. I would not recommend QuoteWizard’s car insurance comparison experience, especially if you don’t enjoy being on the receiving end of random phone calls and texts from sales agents.

SmartFinancial

SmartFinancial’s home page bills itself as the “smart and easy way to shop insurance”. The quote processing tool promises to provide quotes for auto, home, health, and life insurance in minutes, among other insurance types.

How it works: The quoting process did indeed move very quickly with the help of drop-down menus. After asking the usual questions, the tool asked for my email address while claiming, “no spam, ever.”

But before I clicked to view my quotes, I noticed the fine print below, asking me to agree to allow “owner of this website and/or the agents of one or more of the listed businesses to contact me for marketing/telemarketing purposes at the number and address provided above, including my wireless number if provided, using live operators, automated telephone dialing systems, artificial voice or pre-recorded messages, text messages and/or emails, if applicable, even if I have previously registered the provided number on any Federal or State Do Not Call Registry.”

Results: After a short wait, the quoting tool produced buttons for five companies––including Allstate, The Zebra, and Liberty Mutual––that asked me to click to see my quote. There was also an option to speak to a SmartFinancial agent over the phone. When I would click to see a quote, I would be redirected to that company’s website. While most of my personal information was already inputted on those sites, I had to enter additional information before I could finally see my quotes. While the precise quoting process may vary for other customers, I was left wondering why I hadn’t just skipped SmartFinancial in the first place.

ValuePenguin

Like Nerdwallet, ValuePenguin is a personal finance site dedicated to helping consumers make informed decisions about their credit cards, banking, investments, and insurance. The site offers quoting tools, in-depth financial product reviews, and analyses of industry trends.

How it works: ValuePenguin’s quoting tool asked me the typical questions about myself and my vehicle, with the product branded as a partnership with QuoteWizard and LendingTree. The product looked identical to and seemed to work in the exact same way as it did when entering from QuoteWizard’s site.

Results: After answering five or six basic questions, I was taken to a page with a link to just one website: Progressive. When I clicked on the link, I was redirected to the beginning of Progressive’s insurance quoting process. All in all, you’d be better off just skipping ValuePenguin and going straight to a site that will produce quotes for you.

Honorable Mentions

DMV.org

DMV.org is a privately-owned site that helps drivers interact with their local Department of Motor Vehicles. This site is not an official government agency, but acts as a middleman between you and your local DMV. For example, a visitor may renew their vehicle registration or driver’s license on the site for an additional fee. DMV.org is rated 4.3 out of 5, and has 23,147 user reviews on Trustpilot.

How it works: Each state page on the site offers information on required coverage, optional coverage, proof of insurance, vehicle registration, insurance plans, rates, and discounts. They also have an insurance quoting engine that works similarly to those on other lead generation sites.

Results: After working my way through the DMV.org quoting process (which was operated by a site called InsuredNotion), I discovered that they don’t actually provide car insurance quotes on their site, as the extensive fine print at the bottom of the site indicates: “The operator of this website is not an insurance broker or an insurance company… this website does not constitute an offer or solicitation for automobile or other insurance.” Instead, they provide you with links to other websites where you can get a quote. In my case, it gave me exactly two links: to Progressive and to a site called carinsurance.net. Clicking a link to go to one of these websites required me to start all over with the quoting process, leaving me wondering why I’d bothered with DMV.org in the first place.

InsuranceQuotes

InsuranceQuotes is a free, online comparison tool that offers quoting processes for auto, life, health, homeowners, and other types of insurance. The site also has articles on insurance-related subjects and provides information on auto insurance by state, including average rates. InsuranceQuotes is rated 1 out of 10 and has 17 user reviews on Resellerratings.

How it works: The website’s homepage is dated and non-intuitive, though the site’s quoting process asked me for the usual information, including my zip code, marital status, vehicle details, email, and phone number.

Results: I was led to a “quotes page,” showing me seven options, including GEICO and Progressive. There were no live quotes shown on the page. When I clicked on an option, I was redirected to restart the quoting process on that company’s website. Ultimately, InsuranceQuotes seemed to serve little purpose as an insurance comparison product,

NetQuote

NetQuote is a free, online insurance comparison tool that provides leads to insurance agents.

In addition to auto insurance, Netquote also offers quotes for health, home, renters, business, and life insurance. NetQuote is rated 1.2 out of 5, and has 39 user reviews on ConsumerAffairs.

How it works: Once I entered my ZIP code, the site launched its quoting process, which was very similar to that for InsuranceQuotes’—leading me to suspect that the two sites may belong to the same company. Customers can select a tiny, hard-to-see link at the bottom of the webpage called “Do Not Sell My Personal Information” to unsubscribe from advertising emails and offers, making the site’s intended purpose clear.

Results: I was delivered to a results page that also looked identical to InsuranceQuotes’, although the agents who would be calling this time were from Geico, Progressive, and a site called FastInsuranceRates.

Insurance Companies that Compare Quotes

Several insurance providers tout their quote comparison platforms as a way to increase transparency and trust with potential customers. If we compare our rates against those of our competitors, they claim, shouldn’t that tell you that we’re serious about getting you savings? It’s a great advertising ploy, but the results are mixed. One insurance company, Progressive, even offers users their own quote comparison experiences. However, car insurance companies claiming to help customers compare rates with their competitors deserve a critical eye, and customers seeking the most comprehensive motorist coverage comparison experience might choose to look elsewhere.

Progressive

While Progressive hardly has trouble dominating the auto insurance market, it still purports to offer a quotes comparison experience, asking customers to “see how our rates stack up against different companies”. It seems as though Flo and her iconic price gun aren’t out to get you savings through Progressive alone. Does the company practice what it preaches?

How it works: Curious to see if Progressive could find me cheap, non-Progressive rates, I entered my ZIP code, and then was taken to Progressive Direct to complete my quote.

Results: The website noted how many residents in my state had bought a new Progressive auto policy in the past 30 days. After I filled out the entire Progressive application, I got my six-month policy quote. But what happened to comparing Progressive quotes with other companies? I tried with different ZIP codes, and the process remained the same.

I noticed a small link at the bottom of the page asking “Do you provide comparison rates for other companies?” The site’s answer was that Progressive was no longer providing comparison rates in the state I selected due to errors the site discovered in their presentation of competitors’ rates.

However, the site stated that, “Progressive Direct provides rates for other big companies in most states and situations. Once you get a Progressive Direct rate, simply answer a few more questions and, where available, we’ll provide you with rates for other companies.”

It’s admirable that Progressive, as a car insurance company, is seeking to help customers compare auto insurance rates with its top competitors, but unfortunately the comparison product only seems to work in certain zipcodes and situations. Customers may be better off using a comparison-site that works in all fifty states for drivers of all stripes, like Insurify.

Conclusion: Who can offer you the best and cheapest quotes?

Insurance experts suggest that you compare car insurance policies every time your current policy is up for renewal (typically every six months to a year). Before you start your quote hunt, review your existing policy, and see if your needs have changed. For example, many auto lenders will require you to have no more than a $500 deductible in comprehensive/collision coverage—but once you pay off your car loan, you can increase this deductible and save a considerable amount on your insurance premiums. It’s also important to determine your desired amount of coverage: a minimum coverage plan, for example, might cost less initially but leave you with inadequate protection.

Regardless of what level of auto insurance coverage you choose, life changes like gaining driving experience, increasing your credit score, or buying a house could all mean potential savings on your car insurance quote. That’s because renters, teen drivers and young drivers, drivers with poor credit, and drivers with traffic offenses like speeding tickets or DUIs on their record all tend to pay a bit more for car insurance. Drivers who have gone uninsured for a significant period of time also face higher premiums. If you have a clean driving record, don’t spend much time on the road, or are willing to pay for your policy upfront or online, you may be eligible for insurance discounts.

When you’ve worked out just what coverage you need, an auto insurance comparison site can help find the best price for your desired policy. However, you’d be advised to stick to reputable comparison sites that give you real quotes and multiple insurance options, rather than lead generation sites that treat a Florida Honda driver the same as an Aslaskan Ford driver and stick you with cold calls from relentless insurance agents.

You may find that a few minutes spent on a site like Insurify will save you hundreds of dollars a year in car insurance or home insurance costs. Good luck!

Car Insurance Comparison FAQs

Which is the best car insurance comparison site?

Insurify is the top-rated and most-rated car insurance quote comparison site in America. With a 4.8 / 5 customer satisfaction rating on Shopper Approved and over 3,000 customer reviews, Insurify saves an average of $585 per year for users in all 50 states. Other auto insurance comparison sites include Compare.com and The Zebra.

How can I find the best and cheapest car insurance rates?

Online auto insurance quotes comparison is the insurance shopping of the future. Unsafe lead generation sites sell your information to the highest bidder, and agencies won’t always give you the full picture. Only comparison sites provide a no-obligation and free route to car insurance savings based on your financial needs and driver profile.

How many car insurance quotes should I compare?

Don’t rely on one insurance company or agency to get a car insurance quote. Comparing at least four car insurance quotes on a site like Insurify will give you a more accurate idea of how much you can expect to pay in monthly premiums. The average Insurify user can get six or seven real, bindable quotes in a matter of minutes.