For the curious, frustrated, or savings-hungry, here is our official guide to car insurance quotes.

Getting the right car insurance coverage can be as frustrating as it is confusing. Between the confusing jargon and volatile pricing rates, how can you ensure you’re always getting the best deal for you and your needs?

Your car insurance policy begins with you, your coverage needs, and a single number. Find out how to compare car insurance quotes today and save up to 70 percent on your current policy.

Table of Contents

- How to compare free car insurance quotes online

- Cheapest car insurance quotes

- Car insurance quotes: comparing the variables

- What is a car insurance quote?

- What goes into a car insurance quote?

- Factors that impact a car insurance quote

- Car insurance discounts

- Conclusion: Do this now to compare and save

- Methodology

How to compare free car insurance quotes online

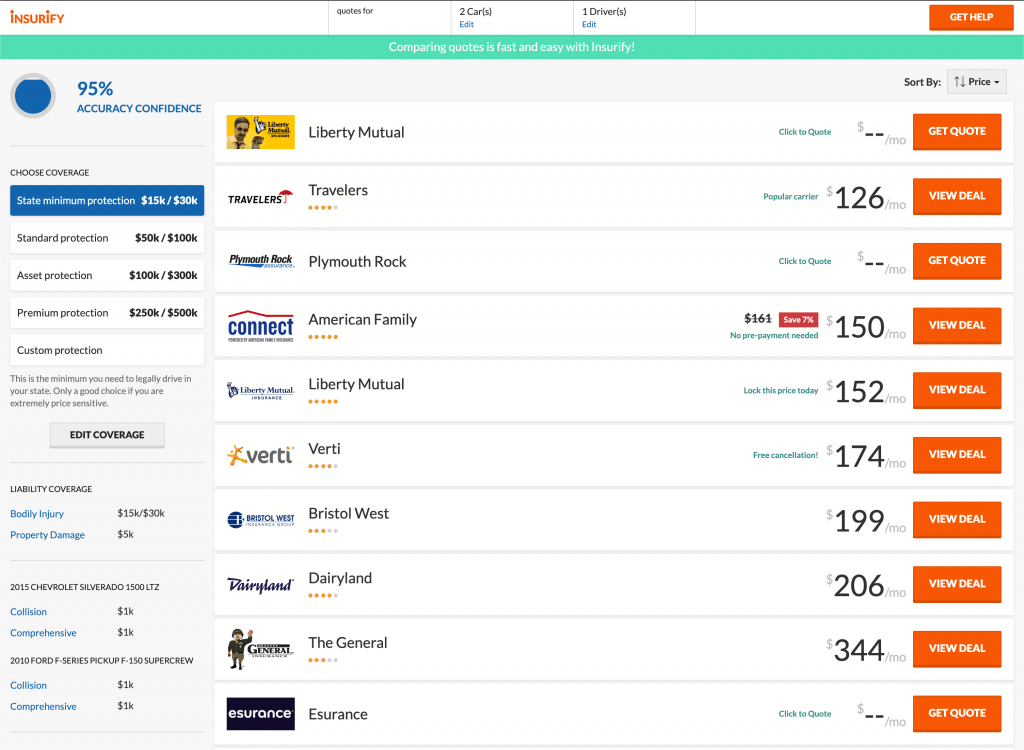

The best way to find and compare cheap car insurance quotes for free is with Insurify.

Don’t trust captive insurance agents or lead generation sites, which aren’t impartial and who gouge you for money. Instead, take your insurance decisions into your own hands and spend a few minutes on Insurify. Just take a few minutes to put in some basic personal information, and soon you’ll be comparing real, ready-to-buy, direct car insurance quotes side by side!

Your information is 100 percent free and secure. Find the right car insurance for you today by unlocking discounts, comparing coverage levels, and buying online or over the phone.

Browse, Compare, Discover with Insurify today!

Car insurance companies with the cheapest average quotes

Looking for the most affordable car insurance quotes in your area? Click on your state of residence here to find the cheapest car insurance quotes in your state.

For more information, visit our ultimate guide to getting cheap car insurance quotes.

Car Insurance Quotes: Comparing the Variables

See how locations and insurance companies stack up when it comes to credit score, coverage levels, marital status, and more.

Car Insurance Quotes by State

Where you live really does affect your car insurance rates. Living in a high-crime neighborhood or an area prone to hurricanes probably means you’ll have to pay higher car insurance premiums. Since your perceived likelihood of filing a claim is higher, insurance companies predict it will cost more to insure your car.

Find the cheapest car insurance quotes near me

| State | Average Monthly Premium |

| Alabama | $168 |

| Alaska | $144 |

| Arizona | $179 |

| Arkansas | $176 |

| California | $195 |

| Colorado | $210 |

| Connecticut | $224 |

| Delaware | $290 |

| District of Columbia | $270 |

| Florida | $291 |

| Georgia | $286 |

| Hawaii | $107 |

| Idaho | $121 |

| Illinois | $157 |

| Indiana | $137 |

| Iowa | $134 |

| Kansas | $165 |

| Kentucky | $245 |

| Louisiana | $293 |

| Maine | $117 |

| Maryland | $270 |

| Massachusetts | $171 |

| Michigan | $479 |

| Minnesota | $147 |

| Mississippi | $189 |

| Missouri | $228 |

| Montana | $144 |

| Nebraska | $177 |

| Nevada | $275 |

| New Hampshire | $142 |

| New Jersey | $259 |

| New Mexico | $147 |

| New York | $308 |

| North Carolina | $119 |

| North Dakota | $143 |

| Ohio | $148 |

| Oklahoma | $170 |

| Oregon | $179 |

| Pennsylvania | $175 |

| Rhode Island | $315 |

| South Carolina | $268 |

| South Dakota | $130 |

| Tennessee | $163 |

| Texas | $231 |

| Utah | $159 |

| Vermont | $130 |

| Virginia | $182 |

| Washington | $217 |

| West Virginia | $181 |

| Wisconsin | $138 |

| Wyoming | $115 |

Click here for more info on how to get car insurance quotes for Uber and Lyft drivers.

Car Insurance Quotes for Full Coverage vs. State Minimum Liability Coverage

Simply put: the more insurance coverage you want, the more you’ll have to pay.

Full Coverage vs. Liability-Only Coverage vs. State Minimum Liability Coverage

“State minimum” refers to the absolute lowest amount of coverage a driver in a given state can legally have. It only includes the lowest coverage levels of liability insurance—meaning it includes no personal protection. Compare the average monthly payment for a state minimum driver versus a driver who opts for $50,000 in bodily injury liability for one person injured in an accident, $100,000 in bodily injury liability for all injuries sustained in one accident, and $50,000 in property damage liability for all property damage incurred in an accident.

Then, see how much adding comprehensive and collision coverage, at a $1,000 deductible each, will bump up your average premium.

| Coverage Type | Average Monthly Premium |

| State Minimum Liability Only | $164 |

| 50/100/50 Liability Only | $177 |

| 50/100/50 + $1,000 Comprehensive/Collision | $329 |

Car Insurance Coverage Level Costs By Company

Not all insurance rates are created equal. Your final premium will vary based on the amount of coverage you choose, but the dollar amount you end up paying out will be determined by your individual insurers’ rating algorithms.

State Minimum Liability Coverage Quotes by Company

| Insurance Provider | Average Monthly Premium |

| Aggressive Insurance | $129 |

| Alinsco | $131 |

| American Family | $193 |

| Arrowhead | $289 |

| Aspen | $159 |

| AssuranceAmerica | $133 |

| Bristol West | $133 |

| Clearcover | $146 |

| Commonwealth Casualty | $156 |

| Dairyland | $119 |

| Direct Auto | $168 |

| Elephant.com | $199 |

| Freedom National | $239 |

| GAINSCO | $143 |

| Hallmark | $98 |

| Homesite | $148 |

| Infinity | $194 |

| Jupiter | $159 |

| Kemper | $171 |

| Liberty Mutual | $166 |

| Mercury | $164 |

| MetLife | $107 |

| Mile Auto | $193 |

| Motion Auto | $141 |

| Quantum | $172 |

| Sun Coast General | $130 |

| Texas Ranger | $191 |

| The General | $231 |

| Travelers | $169 |

50/100/50 Liability-Only Coverage Quotes by Company

| Insurance Provider | Average Monthly Premium |

| Aggressive Insurance | $136 |

| Alinsco | $154 |

| American Family | $200 |

| Arrowhead | $279 |

| Aspen | $183 |

| AssuranceAmerica | $176 |

| Bristol West | $158 |

| Clearcover | $159 |

| Commonwealth Casualty | $170 |

| Dairyland | $152 |

| Direct Auto | $177 |

| Elephant.com | $203 |

| Freedom National | $248 |

| GAINSCO | $152 |

| Hallmark | $118 |

| Infinity | $221 |

| Kemper | $177 |

| Liberty Mutual | $173 |

| Mercury | $178 |

| MetLife | $117 |

| Mile Auto | $214 |

| Sun Coast General | $161 |

| Travelers | $165 |

50/100/50 + $1,000 Comprehensive and Collision (“Full Coverage”) Quotes By Company

| Insurance Provider | Average Monthly Premium |

| 21st Century Insurance | $290 |

| Aggressive Insurance | $299 |

| Alinsco | $279 |

| American Family | $318 |

| Arrowhead | $315 |

| Apparent Insurance | $450 |

| AssuranceAmerica | $311 |

| Bristol West | $378 |

| Clearcover | $278 |

| Commonwealth Casualty | $298 |

| Dairyland | $328 |

| Direct Auto | $416 |

| Elephant.com | $362 |

| Freedom National | $364 |

| GAINSCO | $316 |

| Hallmark | $230 |

| Infinity | $357 |

| Kemper | $309 |

| Liberty Mutual | $304 |

| Mercury | $312 |

| MetLife | $333 |

| Mile Auto | $296 |

| Sun Coast General | $252 |

| Travelers | $304 |

| Verti | $274 |

| Workmen’s | $334 |

The numbers are straightforward: the more protection you add to your hypothetical car insurance policy, the higher your car insurance quote will be. This is true across virtually all car insurance companies.

Car Insurance Quotes by Credit Score

Unfortunately, in many states, it’s fair game to discriminate against drivers based on credit score.

| Credit Score | Average Monthly Premium |

| Excellent | $233 |

| Good | $261 |

| Average | $305 |

| Poor | $379 |

Click here to learn more about car insurance for poor credit.

Car Insurance Quotes for SR-22

An SR-22 certification, a.k.a. Certificate of Financial Responsibility, is proof that you carry enough car insurance coverage to meet your state’s minimum requirements. Drivers are required to get an SR-22 bond after having had their driver’s license suspended or revoked.

Drivers often struggle to find car insurance quotes when they need to file for an SR-22—not all Insurance providers will file on a policyholder’s behalf. Still, because most drivers who require an SR-22 are not opting into high coverage car insurance, they’re able to secure relatively cheap policies.

| SR-22 Certificate? | Average Monthly Premium |

| Yes | $226 |

| No | $260 |

Click here to learn more about SR-22 car insurance quotes.

Compare cheap SR-22 car insurance quotes

Car Insurance Quotes by Gender

There’s a “male penalty” in car insurance, on average. Male-identifying drivers pay slightly more in costs than do female-identifying drivers.

| Gender | Average Monthly Premium |

| Male | $245 |

| Female | $236 |

Men, check out these companies! Here are the cheapest average quotes we could find in the country for male-identifying drivers:

| Farmers | $118/month |

| USH&C | $135/month |

| Safeway | $147/month |

| Hallmark | $149/month |

| First Chicago | $152/month |

Here are the cheapest average quotes we found for female-identifying drivers:

| Farmers | $117/month |

| Safeway | $121/month |

| USH&C | $129/month |

| Hallmark | $146/month |

| First Chicago | $152/month |

Car Insurance Quotes by Age

| Age | Average Monthly Premium |

| Under 40 | $263 |

| Over 40 | $214 |

On average, your car insurance rates will decrease as you “age out” of riskier driving behaviors. Safe drivers under 40: blame your generational cohort! But remember, you’ll qualify for lower and lower rates after years of accident-free driving.

Here are the cheapest car insurance providers we could find for these two age brackets:

Cheapest Car Insurance Quotes for Drivers Under 40

| USH&C | $117/month |

| Farmers | $120/month |

| First Chicago | $157/month |

| Hallmark | $162/month |

| National General | $174/month |

Cheapest Car Insurance Quotes for Drivers Over 40

| USH&C | $87/month |

| First Chicago | $106/month |

| Farmers | $115/month |

| Hallmark | $125/month |

| Freedom National | $135/month |

Click here for more info on the following driver profiles:

Car insurance quotes for minors

Car insurance quotes for teens

Car insurance quotes for permit drivers

Car insurance quotes for 18-year-olds

Car insurance quotes for new drivers

Car insurance quotes for drivers under 25

Car insurance quotes for young adults

Car insurance quotes for international students

Car insurance quotes for Costco members

Car insurance quotes for seniors

Car Insurance Quotes for Married Drivers

On average, married drivers pay slightly less for car insurance than their single counterparts. Why? Chalk it up to the other correlating factors: higher credit scores, stable employment, and larger families—all of which can lead to substantial discounts.

| Marital Status | Average Monthly Premium |

| Single | $264 |

| Married | $245 |

Here are the cheapest average quotes we could find in the country for married drivers. Married drivers can often qualify for married, multi-driver, and multi-policy discounts from insurance providers.

| USH&C | $102/month |

| First Chicago Insurance | $130/month |

| Hallmark | $135/month |

| Farmers | $147/month |

| Commonwealth Casualty | $148/month |

Meanwhile, single drivers can still save. Here are the cheapest average quotes we found for the unmarried:

| USH&C | $108/month |

| Hallmark | $149/month |

| National General | $158/month |

| Aggressive Insurance | $162/month |

| Alinsco | $165/month |

Click here for more info on the following driver profiles:

Car insurance quotes for married couples and newlyweds

Car insurance quotes for seniors

Car insurance quotes for divorced couples

Car Insurance Quotes for Safe Drivers vs. One At-Fault Accident

| Violation Type | Average Monthly Premium |

| No Prior Violations | $232 |

| One Not-At-Fault Accident | $263 |

| One At-Fault Accident | $285 |

Click here for more info on the following driver profiles:

Car insurance quotes after an accident

Car insurance quotes after a speeding ticket

Car insurance quotes for high-risk drivers

Car insurance quotes for bad drivers

Car Insurance Quotes for New Cars vs. Old Cars

Some insurance companies prefer to insure older vehicles—in the event of an accident, these cars won’t call for higher part-replacement costs. But some insurance companies actually quote cheaper for the newer car—perhaps they don’t want to risk insuring vehicles that don’t have up-to-date safety features.

Car Insurance Quotes by Car Age

| Age of Car (Years Old) | Average Monthly Premium |

| 0 | $339 |

| 1 | $340 |

| 2 | $333 |

| 3 | $323 |

| 4 | $319 |

| 5 | $309 |

| 6 | $296 |

| 7 | $286 |

| 8 | $271 |

| 9 | $266 |

| 10 | $252 |

| 11 | $244 |

| 12 | $235 |

| 13 | $221 |

| 14 | $215 |

| 15 | $202 |

| 16 | $194 |

| 17 | $187 |

| 18 | $179 |

| 19 | $176 |

| 20 | $172 |

| 20+ Years Old | $195 |

Car Insurance Quotes by Car Age Group

| Age Group | Average Monthly Premium |

| Under 5 Years Old / Over Years Old | $332 / $257 |

| Under 20 Years Old / Over 20 Years Old | $290 / $195 |

Car Insurance Quotes by Car Age Group, by Company

Check out these sample providers to get an idea of how much they’ll demand on average, depending on the age of the policyholder’s vehicle.

AssuranceAmerica

| Age Group | Average Monthly Premium |

| Under 5 Years Old / Over Years Old | $315 / $243 |

| Under 20 Years Old / Over 20 Years Old | $264 / $170 |

Dairyland

| Age Group | Average Monthly Premium |

| Under 5 Years Old / Over Years Old | $341 / $226 |

| Under 20 Years Old / Over 20 Years Old | $270 / $166 |

Liberty Mutual

| Age Group | Average Monthly Premium |

| Under 5 Years Old / Over Years Old | $331 / $256 |

| Under 20 Years Old / Over 20 Years Old | $284 / $199 |

Safeco

| Age Group | Average Monthly Premium |

| Under 5 Years Old / Over Years Old | $314 / $266 |

| Under 20 Years Old / Over 20 Years Old | $289 / $225 |

Travelers

| Age Group | Average Monthly Premium |

| Under 5 Years Old / Over Years Old | $319 / $286 |

| Under 20 Years Old / Over 20 Years Old | $303 / $252 |

Then there’s classic car insurance, too, which are often packaged and sold as distinct policies. Vintage collectors or restorers should consider getting a specialized policy for their classic cars.

Each insurance company has different policies or standards around insuring older or newer vehicles, which is why it’s essential to compare quotes from multiple providers.

So…what is a car insurance quote?

Auto insurance companies need to give you an idea of how much they’ll charge you for coverage before you make a commitment to buy.

Insurance prices reflect risk. Quote amounts vary from person to person based on the perceived level of risk that a potential policyholder represents to an insurance provider. Because policies are financially underwritten by the insurance company that provides them, the company wants to avoid assuming too much financial risk.

What does this mean?

Think of car insurance as a giant swimming pool full of risk. Everyone contributes some amount of water to fill the pool because any one of those people might need some of that water later to put out a fire.

In the same way, you contribute some money each month (your monthly premium) to an insurance company. If you get into trouble in the future, the company will use some of that money to help you cover costs.

So then why do insurance quotes have to be different for different people and different companies? Because insurance is not a one-size-fits-all system. Your car insurance quote is an estimate of how likely it is you’ll need to take water out of the pool—including how much water, when, and why.

It wouldn’t be fair to have a perfect driver put as much into the pool as a driver with ten accidents on their record, right?

Then there’s the fact that everyone needs varying levels of insurance coverage depending on their location, their driving habits, the size of their family, their type of car…. Why should the owner of the Tesla pay as little as the owner of the pre-owned Honda?

Think about it this way: you drive your own car, travel to your own destinations, and have your own habits behind the wheel. Maybe you’re a fuzzy-dice aficionado, too. Just like your car’s unique vehicle identification number, your wants and needs as a driver are also unique. Perhaps you’re prone to fender benders and are looking for a good accident forgiveness plan from a well-known insurer like Nationwide, State Farm, or USAA.

You need an insurance policy that reflects who you are and how you drive, too.

Sometimes that means you want more out of your insurance coverage, so your premium might be more expensive than your neighbor’s. That’s why it’s especially important to compare multiple quotes before selecting a policy. After all, insurance companies are unique, too—some are known for their customer satisfaction; some are represented by cute and cuddly mascots; some will weigh your level of risk way lower than you think.

So it’s essential to check and compare quotes from multiple companies before deciding what to buy.

Here are some similar terms you might come across in your car insurance shopping journey:

A quote is a tailored estimate of how much your auto insurance policy will cost with a specific insurance company. Quotes aren’t set in stone, however, and can fluctuate once you’ve provided a company with your Social Security Number and VIN. Still, an auto insurance quote is the most accurate prediction of the rate a company will set for you.

A rate is the actual cost of your insurance coverage. All of the factors that go into estimating your quote are what ultimately impact the price you must pay to receive insurance coverage.

A premium is what the insurance company determines you’ll be charged per pay period based on your rate. Your total monthly or annual premium should represent the final cost of your insurance policy after all discounts, coverages, and endorsements have been applied. Typically, a car insurance policy constitutes six months or one year of coverage, divided into monthly installments.

What goes into a car insurance quote?

The following types of auto insurance coverage options make up the basics of a standard policy.

Liability insurance covers the bodily injury and property damage incurred by the victims of an accident for which you’re at fault. It’s up to you (and your insurance company) to pay up so that the non-at-fault driver and/or their passengers don’t suffer massive financial loss.

Liability-only car insurance quotes will correspond only to the state minimum amount of liability coverage: bodily injury liability and property damage liability.

If you opt for state minimum car insurance, that means you’re getting the lowest amount of liability coverage that is legally allowed in your state. That often means you’ll get the cheapest quotes available, but the lowest threshold of insurance coverage. Liability-only insurance won’t be sufficient coverage for any damages or injuries that you suffer as a result of an accident, regardless of fault.

“Full coverage car insurance” is the popular term for car insurance that includes liability, comprehensive, and collision coverage. This is a safer auto policy that covers a broader range of situations wherein you might need insurance to offset the costs of repairing your car.

Comprehensive coverage: If you decide to get comprehensive coverage—and we really advise that you do—then its cost will comprise about 50 percent or more of your overall quote. Typically, comprehensive coverage accounts for the most expensive portion of your quote. Comprehensive guarantees that your car is covered in case of an “Act of God,” such as a fallen tree or damage from an extreme weather event. It also extends to animal collisions, vandalism, and theft.

Collision coverage: Collision insurance pays out damages arising from (you guessed it) a collision, regardless of fault. You and your car won’t be covered without collision insurance if you’re involved in a car accident. This coverage applies to collisions with other vehicles and unmoving objects, as well as pothole damage. Adding collision coverage will also increase the price of your quote.

Other “types” of car insurance coverage appearing in your quoted policy depends on what kinds of coverage you’ve selected during the application process. These insurance options can include:

- Uninsured and underinsured motorist coverage: Consisting of uninsured motorist bodily injury and uninsured motorist property damage, this additional protection covers you if you get into an accident with an uninsured or underinsured driver.

- Medical Payments: This covers reasonable medical costs for you or your passengers in the case of injury from an accident. If a car accident results in serious bodily injury, MedPay can help ease the stress of high medical bills after a hospital visit.

- Personal Injury Protection: Also pays for medical bills. Generally, PIP also pays for loss of wages and death benefits.

- Rental car coverage: If your car is damaged, and the damage is covered under your collision or comprehensive coverage, your insurance company will reimburse you for a rental car.

- Glass and windshield replacement: Sometimes, your comprehensive or collision coverage won’t cover windows and windshield damage. In this case, it’s probably a smart move to buy extra protection for glass and windshield damage.

- Roadside assistance service usually costs only a mere few more dollars on your policy. You can also join the American Automobile Association (AAA) if your preferred insurance provider doesn’t offer a roadside assistance add-on or endorsement.

- Towing and labor coverage: Pays for any expenses associated with towing a totaled or damaged car to a repair shop, and may also cover other towing costs, tire changes, battery services, and lockout services.

-

Whether you’re looking for minimum coverage or a comprehensive plan, check out our resource page to read more about these and other car insurance terms.

What factors will impact my car insurance quote?

If you’re wondering why your car insurance is so high, you’re not alone.

Most drivers can be blissfully unaware of the sheer number of factors that will slightly or significantly alter their car insurance quote.

- Your driving record. Your behavior on the road is a significant indicator of how risky you’ll be in the future. Insurance companies like to see clean a clean driving history—drivers that have never filed an insurance claim are preferable to those that have had to file even the most minor claims. A past traffic citation or a DUI can also raise your auto insurance rates.

- Who you are. Are you a homeowner, or a renter? Do you pay your bills? Your age, gender, marital status, and credit score are all factors that insurance companies can take into account when calculating your quote. Read above to see how each major insurance company typically weighs these variables.

- Location. Insurance costs vary from state to state and from city to city. Local crime rates, regional weather patterns, and state-specific requirements are all factors that will go into how much or how little you’re able to pay for an auto policy.

- Coverage levels. State minimum liability insurance costs less than those same liability limits within a full coverage policy. Furthermore, the higher your liability coverage levels, the more you’re potentially asking an insurance company to pay out if you file a claim.

- Deductible amounts. For any non-liability coverage, you get to decide how much money you’ll have to pay before the insurance coverage kicks in. This flat amount is called a deductible. The higher you set your deductibles, the lower your monthly premium will be, and vice versa. Let your financial situation inform how much you want to pay for an insurance policy, how much you can pay, and how much you’re willing to “risk” by opting out of appropriate coverage.

-

Car insurance discounts

Car insurance companies like GEICO, Progressive, or Allstate might offer you a cheaper car insurance quote if you specify certain traits or driving behaviors that will result in a discount.

For example, adding a teen driver to your policy might automatically qualify you for both multi-driver, teen driver, and student driver discounts at once. Reporting that you have a clean driving record might signal that you can reap the benefits of a good driver discount.

Insurance companies love to offer discounts to drive down costs to increase customer satisfaction and loyalty. And certain programs can mean that your expenses decrease year over year so long as you continue good driving behavior, invest in certain safety precautions, or get your insurance payments in well before they’re due.

Learn more about car insurance discounts here.

Conclusion: The best way to get a cheap car insurance quote

Insurify is your best bet if you’re looking to save money by comparing cheap car insurance quotes side by side. Whether you’re prioritizing savings (we’ve all got to stretch the dollar!), coverage perks, or industry reputation, Insurify puts you in the driver’s seat, letting you choose the real quote you want to buy today. Insurify creates a personalized online quote for you to help ensure that you find the best car insurance at the best rate.

That’s right—real policies, real savings, real fast. Compare car insurance quotes today with free, ready-to-purchase quotes from Insurify.

Frequently Asked Questions

What are car insurance quotes?

Auto insurance quotes are rough estimates of how much your auto insurance policy will cost with a specific insurance company. Quotes aren't set in stone, however, and can fluctuate once you've provided a company with your Social Security Number and VIN. Still, an auto insurance quote is the most accurate prediction of one company’s monthly rate it will charge for your insurance premium. You can compare auto insurance quotes from multiple companies in minutes with a comparison site like Insurify.

Where can I get a car insurance quote?

You can get an auto insurance quote online (direct through an insurance company), over the phone, or in-person at an agency. But generating and comparing multiple quotes is a major time commitment if you don’t use an auto insurance quotes comparison site like Insurify. Compare multiple quotes side by side, with no risk of getting hunted down by robo-calls or scammers. The best part is that Insurify offers fresh, personalized, ready-to-buy quotes after just a few clicks. No surprises or estimations—we’ll show you real quotes upfront based on the exact policy you want.

How do I get multiple car insurance quotes for free online?

To get fast and free auto insurance quotes from the top-rated and cheapest providers in the nation, use an auto insurance quotes comparison site like Insurify. Just a few minutes and a couple of clicks can get you side-by-side insurance rates from multiple companies at once, ranked by price or by recommended coverage. Save time and avoid spam calls by purchasing your new car insurance policy immediately online or over the phone.

Methodology

The data scientists at Insurify compiled quoting data from Insurify’s proprietary database of over 2 million real car insurance quotes, spanning pricing data from 2013 to 2020.

Score savings on car insurance with Insurify